States Funding Transportation Infrastructure: Who’s Doing It?

February 13th, 2017 | By: Maria Matthews

When it comes to infrastructure funding, peer pressure isn’t a bad thing. Over the last several years 19 states have taken it upon themselves to generate new revenue to fund their surface transportation infrastructure. While 2016 session did not rise to match the flurry of activity seen in 2015, and years prior, many states did take that time to consider and debate the proposals that have been queued up this year. This year will see California, Colorado and Washington dive a bit deeper into their vehicle-miles travel pilot programs as an alternative to a gas tax only revenue stream. We are also following transportation funding legislation in a number of states:- Arizona’s legislature is considering a bill that will raise the current 18-cent per gallon gas tax by 10-cents. If enacted, it will be the first-time Arizona has increased its gas tax in 26 years. It is estimated that the purchasing power of the current gas tax has diminished by about 50% since the last increase.

- Indiana has debated the possibility of a gas tax increase over the last few years. This year the legislature is debating a 10-cent per gallon gas tax coupled with an increase in vehicle registration fees, an electric vehicle fee as well as a requirement that the state study toll roads. This proposal has the potential to generate the projected $1.2 billion per year needed to maintain state and local roads.

- New Mexico is debating a bill that will expand the current local gasoline tax to all municipalities and counties across the state. Creating an opportunity for local governments to enact a special fuel tax of no more than one-cent per gallon with a five-cent per gallon maximum has the potential to raise an estimated $40 million for county and municipal roads.

- The Oregon Legislature has released a joint plan whose goals include protecting existing infrastructure, preparing the transportation system for a seismic event, improving public safety by replacing or repair gaining structures, and improving public transportation. The state looks to accomplish their task list by generating revenue through a number of possible stream from the user fees like the gas tax, tolls and vehicle registration to optimizing general revenue streams like the lottery, property taxes and diversions from the general fund.

- South Carolina, like Arizona and Indiana, is also considering a 10-cent per gallon gas tax increase. South Carolina is currently ranks among the lowest gas tax in the nation. If passed, this increase is expected to cost drivers an additional $60 per year in fuel costs. While South Carolina’s drivers may see a slight uptick in the price at the pump, improving road conditions and capacity has the potential to put a dent in the $1,168 – $1,248 per year in additional vehicle operating costs.

- Tennessee’s IMPROVE Act has the potential to raise the gas tax by 7 cents per gallon and index the rate to the Consumer Price Index. This bill will also increase vehicle registration fees and allow for a local option tax to fund local projects. This approach has the potential to help Tennessee begin to close a potential funding shortfall.

California Decides How Voters Impact Infrastructure Projects

October 10th, 2016 | By: Maria Matthews

Proposition 53 is a statewide ballot measure that asks voters to consider whether the state may sell revenue bonds for projects expected to cost over $2 billion. This ballot measure would specifically apply to all projects financed, owned, operated, or managed by the state as well as those of joint agencies formed between the state and localities, another state, or the federal government. Under the California Constitution, state general obligation bonds need voter approval before the state can use them to pay for a project. State revenue bonds, however, do not currently need voter approval under existing state law. On November 8, voters in California will be given the choice of maintaining status quo (casting a “no” vote) or requiring that projects exceeding $2 billion receive voter approval for bonds to be sold (casting a “yes” vote). The ASCE Region 9 Board of Governors has issued an open letter to members encouraging a “no” vote on this measure. The American Society of Civil Engineers (ASCE) supports financially responsible actions by federal, state and local governments to meet America’s infrastructure needs. These actions should support established project and program management principles, including new service and delivery models, innovative financing, appropriate research and technology transfer, and should conform to the principles of sustainability. For this reason, ASCE opposes Proposition 53 and encourages voters to cast a “no” vote. Investment in America’s infrastructure has been deferred and has not focused on either the demand for new facilities and services or the maintenance and repair needs of the aging infrastructure systems. The results are evident in traffic and airport congestion, unsafe bridges and dams, substandard educational facilities, deteriorating roads and inadequate utility systems. Let’s not further deter or delay project completion by requiring funding receive voter approval – something that only comes around every two years. When you head to the polls on November 8, remember to cast a “no” vote on Proposition 53.Safe Roads Amendment Protects Illinois Transportation Dollars

October 3rd, 2016 | By: Maria Matthews

The “Safe Roads Amendment” is a statewide ballot measure that asks voters to decided how the state can spend its transportation dollars. More specifically, this measure will protect transportation revenue (like the gas tax, tolls, licenses and vehicle registration fees) from being diverted to non-transportation projects. Illinois is following in the footsteps of its neighbor Wisconsin, who along with Maryland, passed a similar measure to protect its transportation revenue in 2014. Nearly $6.8 billion has been diverted from the state’s Road Fund over the last 13 years. These are critical dollars that can be used to maintain or improve our roads to ensure public safe and ease of mobility for goods and services throughout the state. A vote “for” provides a reliable source of transportation funding without the creation of new taxes, tolls or user fees. When going to the polls on November 4, remember this:- A “lock box” will be created ensuring funds will only be able to be used for transportation related purposes.

- You will prevent further raiding of the state’s transportation dollars.

- The measure will have no effect on current or future tax rates or spending levels.

- Ensuring funds are available for construction and maintenance of state and local roads will help reduce congestion, improve safety and reliability, create jobs, and boost the state’s economy.

New Jersey Remains Deadlocked on Transportation Trust Fund Fix

August 2nd, 2016 | By: Maria Matthews

It’s now August and few legislative days remain before the start of the State Legislature’s summer recess. What should have been a quick fix at the beginning of July (or during the first six months of the year) is now an ongoing stalemate between the Legislature and the Governor’s Office on whose solution is the best for New Jersey. All parties agree that the 23-cent per gallon gas tax increase is what the State Transportation Trust Fund (TTF) needs to adequately address the state’s transportation needs. Yet, New Jersey now finds itself at the outset of a fourth week of work stoppages since Governor Christie (R-NJ) executive order took effect on July 8. The Governor and Senate President Stephen Sweeney have traded plans over the last few weeks but, ultimately have not come to an agreement on how to offset the 23-cent per gallon gas tax increase. After just shy of a month of inactivity at the state house due to a recess for the National Party Conventions, the Senate Budget and Appropriations Committee returned to Trenton last Friday to take up Senator Sweeney’s (D-NJ) proposal, which has garnered support from Assembly Majority Leader Vincent Prieto (D-NJ), and pushed it through to the full chamber for a floor vote. With a new opportunity to vote on this critical piece of legislation, the Senate has again postponed a vote due to the lack of support necessary to result in a veto override should Christie veto Sweeney’s bill. Projections seem to indicate that the chamber is just a few votes shy of the majority it needs but, all the same are waiting to shore up the count. Estimates from early July indicated that the TTF had only $85 million left to pay for emergency repair work. Despite the fact that shovels have been put down at most projects throughout the state, the balance of the TTF is wearing thin and will soon run dry. With just a single legislative day left before the legislature heads home for its August recess, we need you to send an email now and demand Legislators and the Governor find a compromise that will reopen the shuttered projects and give New Jersey the 21st century infrastructure system it deserves!New Jersey Legislature Misses Opportunity to Fix Transportation Trust Fund

July 6th, 2016 | By: Maria Matthews

Last week, we told you about the looming insolvency of New Jersey’s Transportation Trust Fund (TTF) as the Senate attempted to act before the July 1st deadline. After what looked like a chance to get a bill passed before the deadline did not happen, we are now waiting to hear from legislators and Governor Christie as the state decides how it will move forward now that the TTF is on pace to hit bankruptcy at by the end of July. Talks broke down in the Senate last week over the amended version of a bipartisan bill that was passed by the Assembly. A.10 was passed after careful negotiations with Governor Christie’s office would also reduce the state’s sales tax by 1% to provide further taxpayer savings to cushion the 23-cent per gallon gas tax increase. Concerned that this additional offset would be detrimental to the larger state budget the Senate opted first to postpone a June 30 vote pending further negotiations and later opted to push the vote off until they returned from a mini-recess on July 11. According to some projections, it is anticipated the fund has only $85 million left to pay for emergency repair work. As this is the case, Governor Christie quickly called for work to be ceased on projects funded by the TTF. Federally-funded and toll-funded work would be allowed to move forward. It is expected that the Governor will release a list of projects that will be allowed to continue in an effort to preserve public safety and welfare. No further legislative activity is expected until the Assembly returns on July 11. Until then Senate President Stephen Sweeney (D) is expected to be in negotiations with the Governor’s Staff and his counterparts in the Assembly. Assembly Majority leader Vincent Prieto (D-Hudson) has indicated he is willing to work with the Senate and Governor’s office to find a compromise. Fixing the Transportation Trust Fund with a long-term solution is the first step to raising the grades given by this year’s Infrastructure Report Card. We encourage you to take a moment to tell your state legislators and Governor Christie that immediate action to fix the TTF is needed!New Jersey Must Fix the Transportation Trust Fund

June 30th, 2016 | By: Maria Matthews

Legislators in both chambers worked in a bipartisan manner to address the looming insolvency of New Jersey’s Transportation Trust Fund (TTF) just before the July 1st deadline. The TTF is the account from which the state pays for maintenance, repairs and construction for transportation infrastructure. As introduced by Senators Paul Sarlo (D-Bergen) and Steve Oroho (R-Sussex), and by Assembly Speaker Vincent Prieto (D-Hudson), the bills would increase the gasoline tax by 23 cents per gallon, and impose an approximately 13 cents per gallon tax on jet fuel. To help ease the price at the pump the General Assembly also approved a number of tax offsets. Among them are the discontinuation of the New Jersey estate tax, greater tax exemptions for retirement income and low-income workers, and a new tax deduction for contributions to charities. On Monday, a midnight-hour deal was struck between the Assembly and Governor Christie’s office that would also reduce the state’s sales tax by 1% to provide further taxpayer savings. The Assembly remained in session until 1:30am when a 54-22 vote was achieved with 10 Republicans voting in favor of the bill. It’s now the Senate’s turn to take action and June 30 is the last day for them to act. Take a moment to contact your State Senator and encourage them to support the Assembly’s bill. The 2016 Report Card for New Jersey’s Infrastructure’s roads, bridges, and transit grades of D+, D+ and D-, respectively. Among the most alarming statistics about transportation infrastructure found in the report is that 42% of New Jersey’s roadways are deficient, which means over 16,000 miles of roads are rough, distressed or cracked. Equally glaring is the state of New Jersey’s bridges. One in 11 are categorized as “structurally deficient,” and over 40% of all New Jersey bridges are expected to soon require improvements or complete replacement. Nationally, inefficient infrastructure is costing every household $9 a day. However, if every family instead invested an additional $3 a day per household, we could close the infrastructure investment gap in 10 years. This will take action on the federal, state, and local levels. Fixing the Transportation Trust Fund with a long-term solution will not only help raise the grades given by this year’s Report Card but, also put money back into the wallets of New Jersey families.U.S. School Facilities Are $46B Away from Modern Standards

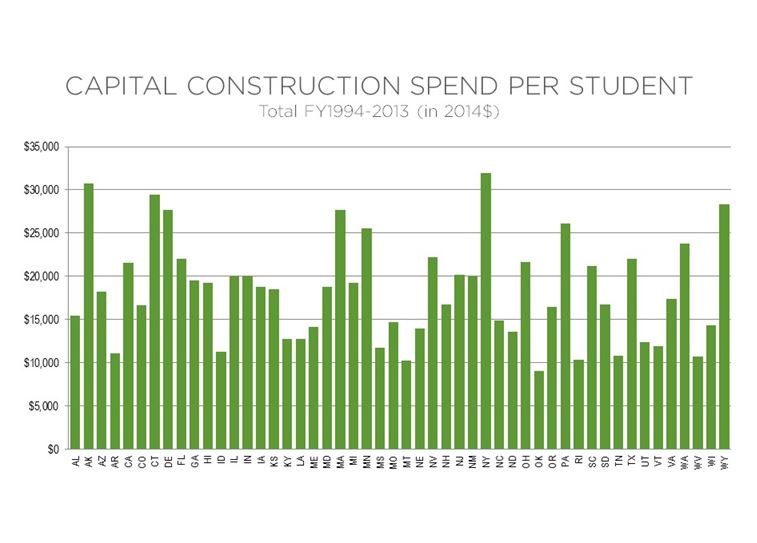

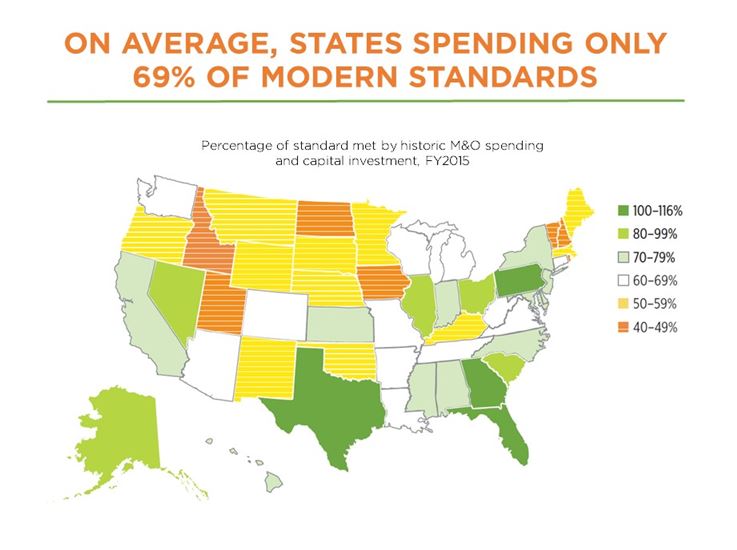

March 29th, 2016 | By: America's Infrastructure Report Card

Want to find out more? Read the full State of Our Schools report. Read the Washington Post coverage of the new report or take a minute to tell your elected officials who make decisions on schools about this new report.

Want to find out more? Read the full State of Our Schools report. Read the Washington Post coverage of the new report or take a minute to tell your elected officials who make decisions on schools about this new report.

Raising Revenue for Infrastructure: Who will be next?

April 14th, 2015 | By: Maria Matthews

Whether it’s been increased, decreased, or frozen the 2015 legislative session has seen a high level of activity from states attempting to modify their gas tax to keep up with their infrastructure needs. We’re keeping a close eye on the nearly 40 states that are still in session and hopeful they will vote “yes” for infrastructure time and again. Among the states to watch closely are Michigan, Missouri, Nebraska, New Jersey, South Carolina and Washington. All have hinted they might take action this year. Here’s what to expect and watch for:- Michigan has put its funding decision in the hands of voters. They’re being asked to go to the polls on May 5th to raise the sales tax by 1% and increase vehicle registration fees. The legislature doesn’t adjourn until December so in the event the ballot measure fails, the state lawmakers will likely head back to the drawing board.

- Nebraska’s legislature is two rounds of voting away from a phased in 6-cent per gallon increase. The bill may meet opposition from the Governor, if it clears the legislature. Its next hurdle would then be a veto override.

- New Jersey is in the unusual position of having to raise revenues to preserve its Transportation Trust Fund The fund is expected to run dry sometime this summer and will indeed impact the way The Garden State maintains its highways and bridges.

- South Carolina has a number of proposals on the table. More importantly than the number of options being considered is the fact that the Legislature and the Governor will need to find common ground when it comes to raising additional revenue for roads. In her State of the State Address, Governor Nikki Haley indicated she would support no more than a 10-cent per gallon tax increase and only if there were offsets in other areas to keep the state competitive with its neighbors.

- Washington state’s legislature has proposed an 11-cent per gallon increase as part of a larger transportation funding package that would also increase a number of driver fees. With a projected adjournment date just around the corner, April 26, hopefully they will finish their work with decisive action for transportation investment.

Tags: Michigan, Nebraska, New Jersey, South Carolina, state, state government, Washington

No Comments »

How Your State Funds School Construction

July 24th, 2014 | By: Infrastructure Report Card

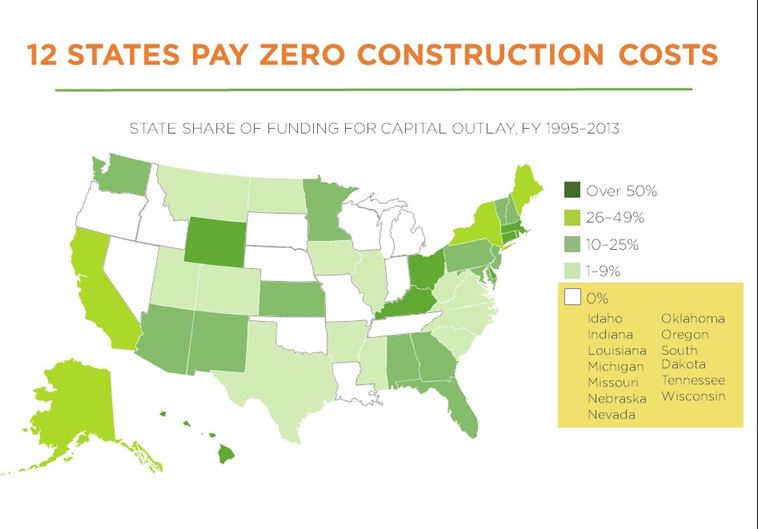

In every community across the U.S. is a school building. They’re used for learning, libraries, sports, and feeding kids, but they’re also used for community meetings, school programs, and in emergencies. Each one of these schools is different, and so it’s probably not a surprise that they’re all funded differently. The Pennsylvania Department of Education recently put together a summary of how all the states fund their capital planning projects like new buildings and modernizations in their Planning and Construction Workbook: A Report to the General Assembly. Here is what they found:

Alabama: The Alabama Department of Education provides annual grants to school districts.

Alaska: The Alaska Department of Education and Early Development provides debt reimbursement and grant funding for individual projects.

Arizona: The Arizona School Facilities Board, through use of the Building Renewal Fund, provides project level grants on a competitive basis for capital improvements to existing facilities. The state also provides formula driven grants for new construction.

Arkansas: The Arkansas Division of Public School Academic Facilities and Transportation provides funds directly to local school districts for qualifying new construction, renovation, or alteration projects.

California: The state distributes facility funding directly to the local school districts through matching grants and reimbursements for individual projects. Generally, funds are distributed on a first come, first served basis, based on eligibility for funding, as determined by projected unhoused students for new construction and age of facilities for modernization.

Colorado: The Colorado Department of Education provides matching grants to local school districts on a competitive basis through the BEST program. The state’s minimum match is determined using several measures of school district wealth in comparison with statewide averages, as well as bond election effort and success over the past decade.

Connecticut: The Connecticut Department of Education provides matching grants to local school districts, with the state share (between 20 and 80 percent) determined by relative district wealth ranking.

Delaware: The Delaware Department of Education provides funding to local school districts for specific projects. The share of state support for public school facilities ranges from 60 to 80 percent and is determined by using an ability construction ratio that looks at the relative property wealth of a school district.

D.C.: The District of Columbia provides the Office of Public Educational Facility Modernization (OPEFM) capital funds for building improvements to the schools within the District of Columbia’s Public School system.

Florida: The Florida Department of Education provides monthly disbursements to local school districts based on available revenues, which are allocated by statutory formulas. (In January of 2012, Florida temporarily halted funding for all school construction projects due to lack of available resources. As a result of this decision, funding for projects was discontinued and schools and colleges were asked to return $250 million to the state until a solution could be identified and agreed upon.)

Georgia: The Georgia Department of Education provides reimbursements to school districts for approved facility projects, with the state facility funding level set by formula in state law.

Hawaii: The Hawaii Department of Education pays directly for local facility projects. Prioritization and state funding allocation is determined based on school building age and condition, as well as student demographics, building health and safety and maintenance needs.

Idaho: The Idaho Department of Education provides local school districts with facility assistance in the form of bond repayment subsidies, allocations for maintenance and emergency funds.

Illinois: The state provides grants to local schools districts for approved projects, with an automatic set‐aside of 20 percent of available state school construction funds allocated to Chicago Public Schools. The level of state funding depends upon district wealth and project type.

Indiana: Indiana provides no funds for school district capital outlay.

Iowa: The Iowa Department of Education provides grants to local school districts using a per pupil allocation formula. An equalization formula is used to distribute aid, with lower wealth school districts getting a higher share of state facility support.

Kansas: The Kansas Department of Education provides funding to local school districts for individual approved projects through three funding streams: bond and interest aid, capital outlay aid and new facilities weighting.

Kentucky: The Kentucky School Facilities Construction Commission provides annual appropriations to local school districts for facility funding through three primary funding sources.

Louisiana: Louisiana provides no funding for school capital outlay projects.

Maine: The Maine Department of Education provides reimbursements to local school districts for capital projects, with funding determinations made based on building condition.

Maryland: Maryland provides direct payments to vendors and reimbursements to local school districts.

Massachusetts: The Massachusetts School Building Authority provides matching reimbursement funds to cities, towns and regional school districts for individual projects. Project funding is determined based on building condition and overcrowding, with funds going to the neediest projects first. The state aid matching percentage varies depending on district wealth, with up to 80 percent of project costs covered for low‐wealth districts.

Michigan: Michigan provides school districts with loans (which must be repaid) to assist in making debt service payment on their qualified bonds.

Minnesota: The Minnesota Department of Education provides facility funding to local school districts through three primary mechanisms: Operating Capital Revenue as a component of the general education funding formula, Debt Service Equalization Aid and Maximum Effort School Aid loans.

Mississippi: The Mississippi Department of Education provides funds to local school districts for approved projects with the amount determined by project type and square footage.

Missouri: Missouri provides no funding to local school districts for capital projects.

Montana: The Montana Office of Public Instruction pays local school districts’ debt service, with state funding dependent on district wealth.

Nebraska: Nebraska provides no financial support to local school districts for capital outlay.

Nevada: Nevada provides no funding to school districts or public charter schools for capital outlay.

New Hampshire: New Hampshire provides reimbursements to school districts for approved capital projects. State funds are allocated based on community wealth equalization and the number of towns that utilize the school.

New Jersey: The New Jersey Department of Education provides project‐level funding to Regular Operating Districts, while Abbott districts are managed by the state with funds paid directly to contractors.

New Mexico: The New Mexico Public School Facilities Authority provides matching grants to local school districts for capital outlay as determined based on state‐established facility adequacy standards. The amount of the state match is based on district wealth.

New York: The New York Department of Education provides school districts with reimbursements for specific projects with state funds allocated based on district wealth and need.

North Carolina: The North Carolina Department of Public Infrastructure provides annual grants to school districts based on average daily membership and tax rate (higher tax rate qualifies for more state funds).

North Dakota: North Dakota provides no regular funding for capital outlay, although recently there have been one‐time appropriations of grant funds to local school districts for capital improvements.

Ohio: The Ohio School Facilities Commission provides matching grants to local school districts based on a legislative formula and rank of the district on the equity list.

Oklahoma: Oklahoma provides no funding to school districts for capital outlay.

Oregon: The Oregon Department of Education provides no funding to local school districts for capital outlay. However, the State Department of Energy has in the past provided $10 million annually for school energy conservation.

Pennsylvania: The Pennsylvania Department of Education provides reimbursements to local school districts for approved school construction projects.

Rhoda Island: The Rhode Island Department of Elementary and Secondary Education provide annual reimbursements to local school districts for approved capital projects. State facility funds are distributed first come, first served, based on need as determined by a community wealth index.

South Carolina: The South Carolina Department of Education provides reimbursements to school districts for approved capital projects, with funding levels determined by a formula that considers need and economy of the school district.

South Dakota: South Dakota provides no funding to local school districts for capital outlay.

Tennessee: Tennessee provides annual capital funds to local school districts through a formula as part of the Basic Education Program (BEP) funds.

Texas: The Texas Education Agency provides debt assistance to local school districts for capital projects through the Existing Debt Allotment (EDA) and Instructional Facilities Allotment (IFA) programs. State funds are allocated by statutory formula, with funding determinations made based on district wealth.

Utah: Utah provides annual non‐matching grants to local school districts based on formula.

Vermont: Vermont provides reimbursements to local school districts for approved projects. State reimbursement levels depend on project type.

Virginia: Virginia provides no grants to counties and cities for their public school capital projects. However, the state does permit the local municipalities to use the state’s credit rating and it provides some school construction funds at subsidized interest rates to school districts that meet program criteria.

Washington: Washington provides reimbursements to local school districts for approved projects. The level of state funding is determined by building condition and need for new space, with a funding formula based on maximum construction cost allocation.

West Virginia: The state provides reimbursements directly to individual approved capital projects. The School Building Authority evaluates projects for funding using established criteria that includes health and safety, reasonable travel time, regional planning, adequate space for projected enrollment, history of efforts to pass local bond issues, regularly scheduled preventative maintenance, and efficient use of funds.

Wisconsin: The state provides no facilities funding to local school districts.

Wyoming: The Wyoming School Facilities Commission (SFC) provides non‐matching grants to local school districts for approved capital projects. Project funding is determined by combining scores from a facility condition assessment, educational functionality, and capacity to create a prioritized needs index that identifies the most critical projects across the state. The SFC pays the full cost of all projects it funds – no local match is required.

In every community across the U.S. is a school building. They’re used for learning, libraries, sports, and feeding kids, but they’re also used for community meetings, school programs, and in emergencies. Each one of these schools is different, and so it’s probably not a surprise that they’re all funded differently. The Pennsylvania Department of Education recently put together a summary of how all the states fund their capital planning projects like new buildings and modernizations in their Planning and Construction Workbook: A Report to the General Assembly. Here is what they found:

Alabama: The Alabama Department of Education provides annual grants to school districts.

Alaska: The Alaska Department of Education and Early Development provides debt reimbursement and grant funding for individual projects.

Arizona: The Arizona School Facilities Board, through use of the Building Renewal Fund, provides project level grants on a competitive basis for capital improvements to existing facilities. The state also provides formula driven grants for new construction.

Arkansas: The Arkansas Division of Public School Academic Facilities and Transportation provides funds directly to local school districts for qualifying new construction, renovation, or alteration projects.

California: The state distributes facility funding directly to the local school districts through matching grants and reimbursements for individual projects. Generally, funds are distributed on a first come, first served basis, based on eligibility for funding, as determined by projected unhoused students for new construction and age of facilities for modernization.

Colorado: The Colorado Department of Education provides matching grants to local school districts on a competitive basis through the BEST program. The state’s minimum match is determined using several measures of school district wealth in comparison with statewide averages, as well as bond election effort and success over the past decade.

Connecticut: The Connecticut Department of Education provides matching grants to local school districts, with the state share (between 20 and 80 percent) determined by relative district wealth ranking.

Delaware: The Delaware Department of Education provides funding to local school districts for specific projects. The share of state support for public school facilities ranges from 60 to 80 percent and is determined by using an ability construction ratio that looks at the relative property wealth of a school district.

D.C.: The District of Columbia provides the Office of Public Educational Facility Modernization (OPEFM) capital funds for building improvements to the schools within the District of Columbia’s Public School system.

Florida: The Florida Department of Education provides monthly disbursements to local school districts based on available revenues, which are allocated by statutory formulas. (In January of 2012, Florida temporarily halted funding for all school construction projects due to lack of available resources. As a result of this decision, funding for projects was discontinued and schools and colleges were asked to return $250 million to the state until a solution could be identified and agreed upon.)

Georgia: The Georgia Department of Education provides reimbursements to school districts for approved facility projects, with the state facility funding level set by formula in state law.

Hawaii: The Hawaii Department of Education pays directly for local facility projects. Prioritization and state funding allocation is determined based on school building age and condition, as well as student demographics, building health and safety and maintenance needs.

Idaho: The Idaho Department of Education provides local school districts with facility assistance in the form of bond repayment subsidies, allocations for maintenance and emergency funds.

Illinois: The state provides grants to local schools districts for approved projects, with an automatic set‐aside of 20 percent of available state school construction funds allocated to Chicago Public Schools. The level of state funding depends upon district wealth and project type.

Indiana: Indiana provides no funds for school district capital outlay.

Iowa: The Iowa Department of Education provides grants to local school districts using a per pupil allocation formula. An equalization formula is used to distribute aid, with lower wealth school districts getting a higher share of state facility support.

Kansas: The Kansas Department of Education provides funding to local school districts for individual approved projects through three funding streams: bond and interest aid, capital outlay aid and new facilities weighting.

Kentucky: The Kentucky School Facilities Construction Commission provides annual appropriations to local school districts for facility funding through three primary funding sources.

Louisiana: Louisiana provides no funding for school capital outlay projects.

Maine: The Maine Department of Education provides reimbursements to local school districts for capital projects, with funding determinations made based on building condition.

Maryland: Maryland provides direct payments to vendors and reimbursements to local school districts.

Massachusetts: The Massachusetts School Building Authority provides matching reimbursement funds to cities, towns and regional school districts for individual projects. Project funding is determined based on building condition and overcrowding, with funds going to the neediest projects first. The state aid matching percentage varies depending on district wealth, with up to 80 percent of project costs covered for low‐wealth districts.

Michigan: Michigan provides school districts with loans (which must be repaid) to assist in making debt service payment on their qualified bonds.

Minnesota: The Minnesota Department of Education provides facility funding to local school districts through three primary mechanisms: Operating Capital Revenue as a component of the general education funding formula, Debt Service Equalization Aid and Maximum Effort School Aid loans.

Mississippi: The Mississippi Department of Education provides funds to local school districts for approved projects with the amount determined by project type and square footage.

Missouri: Missouri provides no funding to local school districts for capital projects.

Montana: The Montana Office of Public Instruction pays local school districts’ debt service, with state funding dependent on district wealth.

Nebraska: Nebraska provides no financial support to local school districts for capital outlay.

Nevada: Nevada provides no funding to school districts or public charter schools for capital outlay.

New Hampshire: New Hampshire provides reimbursements to school districts for approved capital projects. State funds are allocated based on community wealth equalization and the number of towns that utilize the school.

New Jersey: The New Jersey Department of Education provides project‐level funding to Regular Operating Districts, while Abbott districts are managed by the state with funds paid directly to contractors.

New Mexico: The New Mexico Public School Facilities Authority provides matching grants to local school districts for capital outlay as determined based on state‐established facility adequacy standards. The amount of the state match is based on district wealth.

New York: The New York Department of Education provides school districts with reimbursements for specific projects with state funds allocated based on district wealth and need.

North Carolina: The North Carolina Department of Public Infrastructure provides annual grants to school districts based on average daily membership and tax rate (higher tax rate qualifies for more state funds).

North Dakota: North Dakota provides no regular funding for capital outlay, although recently there have been one‐time appropriations of grant funds to local school districts for capital improvements.

Ohio: The Ohio School Facilities Commission provides matching grants to local school districts based on a legislative formula and rank of the district on the equity list.

Oklahoma: Oklahoma provides no funding to school districts for capital outlay.

Oregon: The Oregon Department of Education provides no funding to local school districts for capital outlay. However, the State Department of Energy has in the past provided $10 million annually for school energy conservation.

Pennsylvania: The Pennsylvania Department of Education provides reimbursements to local school districts for approved school construction projects.

Rhoda Island: The Rhode Island Department of Elementary and Secondary Education provide annual reimbursements to local school districts for approved capital projects. State facility funds are distributed first come, first served, based on need as determined by a community wealth index.

South Carolina: The South Carolina Department of Education provides reimbursements to school districts for approved capital projects, with funding levels determined by a formula that considers need and economy of the school district.

South Dakota: South Dakota provides no funding to local school districts for capital outlay.

Tennessee: Tennessee provides annual capital funds to local school districts through a formula as part of the Basic Education Program (BEP) funds.

Texas: The Texas Education Agency provides debt assistance to local school districts for capital projects through the Existing Debt Allotment (EDA) and Instructional Facilities Allotment (IFA) programs. State funds are allocated by statutory formula, with funding determinations made based on district wealth.

Utah: Utah provides annual non‐matching grants to local school districts based on formula.

Vermont: Vermont provides reimbursements to local school districts for approved projects. State reimbursement levels depend on project type.

Virginia: Virginia provides no grants to counties and cities for their public school capital projects. However, the state does permit the local municipalities to use the state’s credit rating and it provides some school construction funds at subsidized interest rates to school districts that meet program criteria.

Washington: Washington provides reimbursements to local school districts for approved projects. The level of state funding is determined by building condition and need for new space, with a funding formula based on maximum construction cost allocation.

West Virginia: The state provides reimbursements directly to individual approved capital projects. The School Building Authority evaluates projects for funding using established criteria that includes health and safety, reasonable travel time, regional planning, adequate space for projected enrollment, history of efforts to pass local bond issues, regularly scheduled preventative maintenance, and efficient use of funds.

Wisconsin: The state provides no facilities funding to local school districts.

Wyoming: The Wyoming School Facilities Commission (SFC) provides non‐matching grants to local school districts for approved capital projects. Project funding is determined by combining scores from a facility condition assessment, educational functionality, and capacity to create a prioritized needs index that identifies the most critical projects across the state. The SFC pays the full cost of all projects it funds – no local match is required.

Tags: capital, Funding, school, school facilities, state

No Comments »

Half of States Have a Gas Tax Policy That's a Decade Old

April 3rd, 2014 | By: Infrastructure Report Card

The Institute on Taxation and Economic Policy (ITEP) released a new chart this week clearly showing how long it’s been since many states have changed their gas tax policy. In about half the states, it has been a decade or more since they’ve changed their gas tax policy in spite of the changing costs for materials, machines, or projects overall. While a minor policy like indexing or switching to a “variable-rate” tax may seem small, consider what we all learned from the hit movie Office Space – even a fraction of a penny can add up to a lot over time. If we’re going to keep up with America’s growth, we need to start counting our pennies a bit differently. Here’s a few of the other key findings from this chart:

• Twenty-four states have gone a decade or more without an increase in their gas tax rate.

• Sixteen states have gone two decades or more without a gas tax increase.

• Seven states have not seen an increase in their gas tax rate since the 1980’s or earlier: Alaska, Virginia, Oklahoma, Iowa, Mississippi, South Carolina, and Tennessee.

• Among the thirty-two states levying a “fixed-rate” gas tax, the average length of time since the last gas tax increase is 17.2 years.

• Most states levying a more sustainable “variable-rate” gas tax, by contrast, have seen their gas tax rate rise some time in the last twelve months

Read the full ITEP report here.

Here’s a few of the other key findings from this chart:

• Twenty-four states have gone a decade or more without an increase in their gas tax rate.

• Sixteen states have gone two decades or more without a gas tax increase.

• Seven states have not seen an increase in their gas tax rate since the 1980’s or earlier: Alaska, Virginia, Oklahoma, Iowa, Mississippi, South Carolina, and Tennessee.

• Among the thirty-two states levying a “fixed-rate” gas tax, the average length of time since the last gas tax increase is 17.2 years.

• Most states levying a more sustainable “variable-rate” gas tax, by contrast, have seen their gas tax rate rise some time in the last twelve months

Read the full ITEP report here.

Tags: infrastructure, policy, state, tax, transportation

No Comments »

*/ ?>

*/ ?>