States Funding Transportation Infrastructure: Who’s Doing It?

February 13th, 2017 | By: Maria Matthews

When it comes to infrastructure funding, peer pressure isn’t a bad thing. Over the last several years 19 states have taken it upon themselves to generate new revenue to fund their surface transportation infrastructure. While 2016 session did not rise to match the flurry of activity seen in 2015, and years prior, many states did take that time to consider and debate the proposals that have been queued up this year. This year will see California, Colorado and Washington dive a bit deeper into their vehicle-miles travel pilot programs as an alternative to a gas tax only revenue stream. We are also following transportation funding legislation in a number of states:- Arizona’s legislature is considering a bill that will raise the current 18-cent per gallon gas tax by 10-cents. If enacted, it will be the first-time Arizona has increased its gas tax in 26 years. It is estimated that the purchasing power of the current gas tax has diminished by about 50% since the last increase.

- Indiana has debated the possibility of a gas tax increase over the last few years. This year the legislature is debating a 10-cent per gallon gas tax coupled with an increase in vehicle registration fees, an electric vehicle fee as well as a requirement that the state study toll roads. This proposal has the potential to generate the projected $1.2 billion per year needed to maintain state and local roads.

- New Mexico is debating a bill that will expand the current local gasoline tax to all municipalities and counties across the state. Creating an opportunity for local governments to enact a special fuel tax of no more than one-cent per gallon with a five-cent per gallon maximum has the potential to raise an estimated $40 million for county and municipal roads.

- The Oregon Legislature has released a joint plan whose goals include protecting existing infrastructure, preparing the transportation system for a seismic event, improving public safety by replacing or repair gaining structures, and improving public transportation. The state looks to accomplish their task list by generating revenue through a number of possible stream from the user fees like the gas tax, tolls and vehicle registration to optimizing general revenue streams like the lottery, property taxes and diversions from the general fund.

- South Carolina, like Arizona and Indiana, is also considering a 10-cent per gallon gas tax increase. South Carolina is currently ranks among the lowest gas tax in the nation. If passed, this increase is expected to cost drivers an additional $60 per year in fuel costs. While South Carolina’s drivers may see a slight uptick in the price at the pump, improving road conditions and capacity has the potential to put a dent in the $1,168 – $1,248 per year in additional vehicle operating costs.

- Tennessee’s IMPROVE Act has the potential to raise the gas tax by 7 cents per gallon and index the rate to the Consumer Price Index. This bill will also increase vehicle registration fees and allow for a local option tax to fund local projects. This approach has the potential to help Tennessee begin to close a potential funding shortfall.

Senate EPW Committee Examines How to Modernize America’s Infrastructure

February 9th, 2017 | By: Laura Hale

On Wednesday the Senate’s Environment and Public Works committee held its first oversight hearing of the 115th Congress (video available here) and new Chairman John Barrasso (R-WY) started things off by making it clear where he stands on the proposal offered by President Trump’s campaign to use private investment to improve our nation’s infrastructure:“Funding solutions that involve public-private partnerships, as have been discussed by administration officials, may be innovative solutions for crumbling inner cities, but do not work for rural areas….Public-private partnerships and other approaches to infrastructure investment that depend on a positive revenue stream from a project are not a surface transportation infrastructure solution for rural states.”A panel of five state and local government officials representing Colorado, Delaware, Oklahoma, West Virginia and Wyoming appeared before the Committee and spoke about what their communities need from the federal government to modernize their infrastructure (written testimony available here). Cindy Bobbitt, Commissioner of Grant County, Oklahoma, emphasized that while public-private partnerships might not be a good fit for rural counties like hers, municipal bonds are. Ms. Bobbitt asked Congress to protect tax-exempt municipal bonds. (A bit of background: Republican leadership has declared tax reform a top priority in this Congress and is planning a broad overhaul of the tax code. State and local governments, which rely on municipal bonds to finance infrastructure and community projects, fear that the tax-exempt status of municipal bonds could be changed. Stakeholders, including ASCE, have joined together to ask Congress to protect tax-exempt municipal bonds.) William Panos, Director of the Wyoming Department of Transportation, drew the Committee’s attention to the fact that the increased spending levels authorized by the FAST Act (enacted December 2015) have yet to take effect. Because Congress has not passed a FY17 spending bill (despite the federal fiscal year 2017 beginning October 1, 2016) and instead kept the government open via two Continuing Resolutions (CRs), funding for surface transportation is still at FY16’s (i.e. pre-FAST Act) authorized levels. Mr. Panos said the use of repeated CRs “restricts our ability to plan for future projects and in our state we’re working with our state legislature now and we needed to ask for twice the amount of borrowing authority we would have otherwise” to be able to cover cashflow needs in the face of federal funding uncertainty. Ranking Member Tom Carper (D-DE) also took the opportunity to highlight the fact that Wyoming raised its gas tax by 10 cents in 2013, while the federal gas tax has not been raised since 1993 and the Highway Trust Fund will run out of money in 2020 without Congressional action. Next week has more transportation-related hearings in store. The Senate Commerce, Science and Transportation Committee’s Subcommittee on Surface Transportation and Merchant Marine Infrastructure, Safety and Security will hold a hearing on stakeholder perspectives on a multimodal transportation. The House Energy and Commerce Committee’s Subcommittee on Digital Commerce and Consumer Protection will hold a hearing on the road to deployment of driverless cars.

Tennessee Senate Committee Receives Infrastructure Report Card

February 7th, 2017 | By: Becky Moylan

As Tennessee’s legislature and governor explore funding options for the state’s transportation infrastructure, the Tennessee Section of ASCE was invited to present the 2016 Report Card for Tennessee’s Infrastructure to the state’s Senate Transportation and Safety Committee. WBIR.com even named it as one of “5 things to watch this week in the legislature.” On Monday, Feb. 6, Monica Sartain, PE and Lukas Slayer presented the Tennessee Report Card, which graded roads a C+, bridges a B, and transit a D+, but warns that without sustainable funding congestion will continue to rise and roads and bridges will deteriorate. Current funding is not keeping up with the needs, as an estimated $475 million is needed annually to maintain the current state of good repair on state-maintained roadways, and this number grows with inflation every year. Tennessee is unique in that it’s one of only five states that is “pay-as-you-go” for transportation projects, meaning that the state takes on no debt for construction or maintenance. While this is a fiscally sound approach, it has made maintaining and improving the system challenging. In January, Gov. Haslam proposed the IMPROVE Act, “Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy,” which would raise the state’s gas tax by 7 cents a gallon and diesel by 12 cents a gallon, ultimately raising $278 million in new dollars and funding 962 projects across the state. The Tennessee’s Report Card’s top recommendation to improve the state’s infrastructure was to “Find sustainable solutions that will help us build a transportation network for the future.” The IMPROVE Act or another bill that would raise the state gas tax—last increased in 1989—is the most direct and immediate way to increase revenue to invest in transportation. ASCE will continue to encourage action this legislative session on the IMPROVE Act or another long-term sustainable funding solution. Join in by emailing your Tennessee state legislators.The FAST Act Turns One, But The Work’s Not Done

December 5th, 2016 | By: Laura Hale

This Sunday was the one year anniversary of the signing of the FAST Act, the five-year federal surface transportation authorization. The law authorizes federal funding for highways, bridges, transit systems and railroads. The passage of the FAST Act was a victory for proponents of infrastructure and everyday Americans who use it. It provided a small increase in funding and was the first long-term authorization bill in years, which provides states the certainty to plan and build projects. However, the passage of the FAST Act did not mean Congress can be done with transportation infrastructure until 2020. Even with the increase in federal funding the FAST Act provided, the nation’s surface transportation system (its roads, bridges, rail and transit) is in need of repair and we’re investing less than half of what’s needed. In May of this year, ASCE released an economic study examining the nation’s investment in infrastructure and its economic consequences. The study found the U.S. was on track to invest about $940 million in surface transportation over the next decade (from all levels of government and the private sector), leaving a $1.1 trillion gap. This underinvestment will have a cascading impact on the nation’s economy, impacting productivity, GDP, employment, personal income, international competitiveness and, most importantly, public safety. Every year this investment gap, along with that of other infrastructure categories, is not addressed it will cost American families $3,400. A large part of the problem is there has not been enough federal funding available for surface transportation infrastructure. The Highway Trust Fund (HTF) is supposed to fund the federal government’s investments in roads, bridges and transit, but an insufficient revenue stream has limited these investments. The HTF is primarily funded by the federal motor fuels tax of 18.4 cents per gallon on gasoline and 24.4 on diesel. The tax has not been raised since 1993 and inflation has decreased its real value by 40%. To make up for the shortfall, Congress has been diverting general fund dollars into the HTF since 2008. Congress failed to provide the HTF a sustainable funding source in the FAST Act and instead relied once again on a general fund transfer. In order to fix the country’s existing infrastructure and build new infrastructure to meet the needs of our growing and evolving nation, the U.S. needs to treat infrastructure spending as an investment in its future. This must include providing the HTF a reliable and sufficient revenue source so the U.S. can get to work fixing and modernizing its roads, bridges and transit systems. Experience shows that it will take time to deliberate the best course of action and build consensus, so the 115th Congress will need to start working right away on fixing the trust fund, rather than waiting until the authorization runs out. Every day they delay, deteriorating infrastructure costs American families.With Gas Prices Low, Congress Has Opportunity to #FixTheTrustFund

August 8th, 2016 | By: Laura Hale

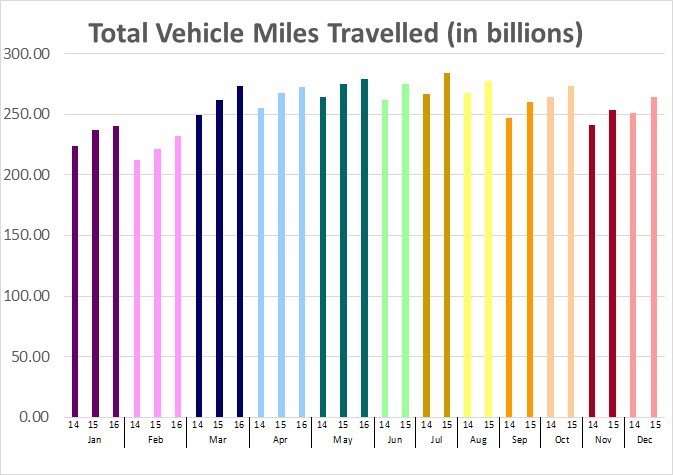

Last month’s average gas price in the U.S. was the lowest for July since 2004. Cheap gas coupled with an improved economy is spurring Americans to drive more. After a decrease during the recession, vehicle miles traveled (VMT) is climbing again. Summer is the busiest time on U.S. roads and many drivers will find themselves stuck in traffic, whether they’re headed to work or the beach. In 2014, Americans spent 6.9 billion hours sitting in traffic (42 hours per driver). The wasted time and gas add up—the total cost of congestion in 2014 was $160 billion ($960 per driver). Estimated VMT based on traffic volume trends. Federal Highway Administration.

Estimated VMT based on traffic volume trends. Federal Highway Administration.

New Jersey Remains Deadlocked on Transportation Trust Fund Fix

August 2nd, 2016 | By: Maria Matthews

It’s now August and few legislative days remain before the start of the State Legislature’s summer recess. What should have been a quick fix at the beginning of July (or during the first six months of the year) is now an ongoing stalemate between the Legislature and the Governor’s Office on whose solution is the best for New Jersey. All parties agree that the 23-cent per gallon gas tax increase is what the State Transportation Trust Fund (TTF) needs to adequately address the state’s transportation needs. Yet, New Jersey now finds itself at the outset of a fourth week of work stoppages since Governor Christie (R-NJ) executive order took effect on July 8. The Governor and Senate President Stephen Sweeney have traded plans over the last few weeks but, ultimately have not come to an agreement on how to offset the 23-cent per gallon gas tax increase. After just shy of a month of inactivity at the state house due to a recess for the National Party Conventions, the Senate Budget and Appropriations Committee returned to Trenton last Friday to take up Senator Sweeney’s (D-NJ) proposal, which has garnered support from Assembly Majority Leader Vincent Prieto (D-NJ), and pushed it through to the full chamber for a floor vote. With a new opportunity to vote on this critical piece of legislation, the Senate has again postponed a vote due to the lack of support necessary to result in a veto override should Christie veto Sweeney’s bill. Projections seem to indicate that the chamber is just a few votes shy of the majority it needs but, all the same are waiting to shore up the count. Estimates from early July indicated that the TTF had only $85 million left to pay for emergency repair work. Despite the fact that shovels have been put down at most projects throughout the state, the balance of the TTF is wearing thin and will soon run dry. With just a single legislative day left before the legislature heads home for its August recess, we need you to send an email now and demand Legislators and the Governor find a compromise that will reopen the shuttered projects and give New Jersey the 21st century infrastructure system it deserves!New Jersey Legislature Misses Opportunity to Fix Transportation Trust Fund

July 6th, 2016 | By: Maria Matthews

Last week, we told you about the looming insolvency of New Jersey’s Transportation Trust Fund (TTF) as the Senate attempted to act before the July 1st deadline. After what looked like a chance to get a bill passed before the deadline did not happen, we are now waiting to hear from legislators and Governor Christie as the state decides how it will move forward now that the TTF is on pace to hit bankruptcy at by the end of July. Talks broke down in the Senate last week over the amended version of a bipartisan bill that was passed by the Assembly. A.10 was passed after careful negotiations with Governor Christie’s office would also reduce the state’s sales tax by 1% to provide further taxpayer savings to cushion the 23-cent per gallon gas tax increase. Concerned that this additional offset would be detrimental to the larger state budget the Senate opted first to postpone a June 30 vote pending further negotiations and later opted to push the vote off until they returned from a mini-recess on July 11. According to some projections, it is anticipated the fund has only $85 million left to pay for emergency repair work. As this is the case, Governor Christie quickly called for work to be ceased on projects funded by the TTF. Federally-funded and toll-funded work would be allowed to move forward. It is expected that the Governor will release a list of projects that will be allowed to continue in an effort to preserve public safety and welfare. No further legislative activity is expected until the Assembly returns on July 11. Until then Senate President Stephen Sweeney (D) is expected to be in negotiations with the Governor’s Staff and his counterparts in the Assembly. Assembly Majority leader Vincent Prieto (D-Hudson) has indicated he is willing to work with the Senate and Governor’s office to find a compromise. Fixing the Transportation Trust Fund with a long-term solution is the first step to raising the grades given by this year’s Infrastructure Report Card. We encourage you to take a moment to tell your state legislators and Governor Christie that immediate action to fix the TTF is needed!New Jersey Must Fix the Transportation Trust Fund

June 30th, 2016 | By: Maria Matthews

Legislators in both chambers worked in a bipartisan manner to address the looming insolvency of New Jersey’s Transportation Trust Fund (TTF) just before the July 1st deadline. The TTF is the account from which the state pays for maintenance, repairs and construction for transportation infrastructure. As introduced by Senators Paul Sarlo (D-Bergen) and Steve Oroho (R-Sussex), and by Assembly Speaker Vincent Prieto (D-Hudson), the bills would increase the gasoline tax by 23 cents per gallon, and impose an approximately 13 cents per gallon tax on jet fuel. To help ease the price at the pump the General Assembly also approved a number of tax offsets. Among them are the discontinuation of the New Jersey estate tax, greater tax exemptions for retirement income and low-income workers, and a new tax deduction for contributions to charities. On Monday, a midnight-hour deal was struck between the Assembly and Governor Christie’s office that would also reduce the state’s sales tax by 1% to provide further taxpayer savings. The Assembly remained in session until 1:30am when a 54-22 vote was achieved with 10 Republicans voting in favor of the bill. It’s now the Senate’s turn to take action and June 30 is the last day for them to act. Take a moment to contact your State Senator and encourage them to support the Assembly’s bill. The 2016 Report Card for New Jersey’s Infrastructure’s roads, bridges, and transit grades of D+, D+ and D-, respectively. Among the most alarming statistics about transportation infrastructure found in the report is that 42% of New Jersey’s roadways are deficient, which means over 16,000 miles of roads are rough, distressed or cracked. Equally glaring is the state of New Jersey’s bridges. One in 11 are categorized as “structurally deficient,” and over 40% of all New Jersey bridges are expected to soon require improvements or complete replacement. Nationally, inefficient infrastructure is costing every household $9 a day. However, if every family instead invested an additional $3 a day per household, we could close the infrastructure investment gap in 10 years. This will take action on the federal, state, and local levels. Fixing the Transportation Trust Fund with a long-term solution will not only help raise the grades given by this year’s Report Card but, also put money back into the wallets of New Jersey families.130 Congressmen Ask Colleagues to Fix the Highway Trust Fund

June 3rd, 2016 | By: Laura Hale

Last week 130 Members of Congress (73 Democrats and 57 Republicans) sent a letter to Chairman Brady (R-TX) and Ranking Member Levin (D-MI) of the House Ways & Means Committee urging them to include addressing the long-term solvency of the Federal Highway Trust Fund (HTF) in their plans for overhauling the U.S. tax code. They wrote: “The need for improvements to our nation’s infrastructure and safety programs is long overdue. However, the current finances of the HTF make it unable to support those investments…We recognize that tax reform legislation will be a heavy lift. Finding a solution requires ingenuity and will involve building consensus among competing interests and ideas, but we stand ready to work in partnership to reach this critical goal.” The HTF is supposed to fully fund the federal government’s investments in roads, bridges and transit, but for several years now it has been spending more money than it is taking in. The root of the HTF’s solvency problem lies in its primary funding source: the federal motor fuels tax. The federal motor fuels tax of 18.4 cents per gallon for gas and 24.4 for diesel has not been raised since 1993 and inflation has decreased its real value by 40%. To fill the gap, Congress has been diverting general fund dollars into the HTF since 2008. The FAST Act, the five year surface transportation bill signed in December 2015, included a $70 billion transfer from the general fund to the HTF. Even with the passage of the FAST Act, our nation’s current level of investment in surface transportation is less than half of what’s actually needed. ASCE’s new report shows that the U.S. needs to invest an additional $1.1 trillion in surface transportation over the next ten years (from federal, state, local and private sources). Failing to sufficiently invest in America’s deteriorating infrastructure will have a cascading impact on our nation’s economy, impacting business productivity, GDP, employment, personal income, international competitiveness, and, most importantly, public safety. The report found that if the surface transportation funding gap is not addressed, the U.S. will lose over $1.2 trillion in GDP and 1.1 million jobs by 2025. Over the past 30 years, all increases in the federal motor fuels tax have occurred as a part of larger tax reform packages, Therefore, Reps. Brady and Levin’s work could offer an opportunity for Congress to finally provide an adequate, sustainable funding source for the HTF. ASCE strongly supports increasing the federal motor fuels tax a sufficient amount at the federal level to stop the need for general fund transfers and allow for increased investment to close the widening gap. Additionally, ASCE supports the creation of additional pilot programs to test charging motorists based on how much they use roads with the long-term goal of using mileage-based user fees to fund the federal HTF.State Legislatures Focus on Infrastructure and Professional Practice Issues

April 19th, 2016 | By: Maria Matthews

While infrastructure issues have remained at the forefront of 2016 state legislative debates, the activity seen during this session is much less impressive than the 2015 legislative season. However, in addition to tackling the question of infrastructure, some states have lumped in professional practice issues like “qualifications based selection” (QBS) as they contemplate their budgets and efficiencies.

Despite the fact that the increases in investment have come more slowly this session, ASCE and its members stepped forward on a number of bills to ensure the Society’s position was heard and bills were advanced, and halted, as needed. Here is just a taste of the activity we’ve been following from coast to coast:

While infrastructure issues have remained at the forefront of 2016 state legislative debates, the activity seen during this session is much less impressive than the 2015 legislative season. However, in addition to tackling the question of infrastructure, some states have lumped in professional practice issues like “qualifications based selection” (QBS) as they contemplate their budgets and efficiencies.

Despite the fact that the increases in investment have come more slowly this session, ASCE and its members stepped forward on a number of bills to ensure the Society’s position was heard and bills were advanced, and halted, as needed. Here is just a taste of the activity we’ve been following from coast to coast:

- Alabama – Just a vote away from seeing a 6-cent per gallon increase. This will be the state’s first increase in nearly 25 years. The legislature here opted to pair the increase with the creation of the Alabama Transportation Safety Fund the recipient of the newly generated revenue. The Safety Fund has already been passed into law and is simply awaiting a final vote of its would-be funding source.

- Connecticut – Governor Dannel Malloy’s is looking to advance his Let’s Go CT! Plan, a 30 year vision for the future of Connecticut’s transportation system. As the legislature nears the end of its session it has yet to approve the “lockbox” ballot measure that is a critical component to protecting the state’s investment in its transportation infrastructure.

- Georgia & Kansas – While over 700 miles separate these state capitals legislators here seemed to be of like minds this session. Georgia introduced SB 366 a bill that would have eliminated QBS for transportation contracts. ASCE opposed this bill and it found itself stalled in the House Transportation Committee. The legislature is looking to study the impact of the bill this summer. Meanwhile in Kansas, a study was commissioned that encouraged legislatures to consider introducing a similar anti-QBS bill as a means of more effectively using state funds. ASCE is also opposing this concept and to date we have not seen a bill.

- Indiana – While the legislature did not pass Governor Mike Pence’s $1 billion transportation proposal, it did pass a transportation package. The plan ultimately passed, relies on transfers from the general fund and the Major Moves 2020 Fund as well as creating mechanisms to increase funding at the local level. In addition to addressing the funding question, the package also creates additional mechanism for distributing transportation funds to localities as well as commissions a study to develop a long term maintenance plan.

- Missouri – Now finds itself just one vote away from putting a 6-cent per gallon gas tax increase on the November ballot. While the bill, SB 623, seemed to have stalled early on in the session. It received a breath of fresh air when green-lighted by State Senator Doug Libla. The bill which originally included a 1.5 cent per gallon increase, saw the threshold increased to 6.5 cents per gallon and quickly made its way to the House.

- Nebraska – Building on its successful increase of the gas tax in 2015, the Nebraska Legislature returned this session with a desire to protect the additional revenue it will generate. It passed into law the Transportation Innovation Act which creates an Infrastructure Bank which will initially receive $50 million from cash reserves and an expected $400 million from the additional revenue generated thanks to the gas tax increase.

- West Virginia – The legislature here came close to seeing a 3-cent per gallon gas tax increase as it brought its session as a close in March. SB 555 picked up momentum back as the session entered its final two weeks but, did not have enough time to clear the House. We’re hopeful this momentum will tee up the legislature to introduce similar legislature upon their return in January 2017.

*/ ?>

*/ ?>