House Passes Resolution Limiting Options to Fix the Highway Trust Fund

June 10th, 2016 | By: Laura Hale

Today the U.S. House of Representatives passed H. Con. Res. 112, a resolution introduced by Rep. Boustany (R-LA) and co-sponsored by 11 Republicans expressing Congress’ opposition to new fees on oil. As yesterday’s blog post highlighted, this resolution may be non-binding, but it puts Congress on the record in opposition to a viable option for fixing the Highway Trust Fund (HTF). Because the gas tax rate has not kept up with inflation, the HTF has been on the brink of insolvency many times in the past several years. Instead of addressing the HTF’s long-term solvency problem, Congress has relied on general funds transfers for the past eight years to prop up the fund, including most recently in the FAST Act. Rep. DeFazio (D-OR), ranking member of the Transportation and Infrastructure Committee, spoke passionately in opposition to the resolution. In under 24 hours, over 200 advocates responded to ASCE’s action alert and contacted their representatives in opposition to H. Con. Res. 112. Along with 30 coalition partners, ASCE sent a letter to Congress opposing the resolution. Rep. Blumenauer (D-OR) read extensively from the letter in his remarks on the House floor. As a concurrent resolution, H. Con. Res. 112 will pass over the Senate for debate and vote. It remains to be seen if that body will pick up the measure.Congressional Vote Could Limit Options to #FixTheTrustFund

June 9th, 2016 | By: Laura Hale

Tomorrow the U.S. House of Representatives will vote on H. Con. Res. 112, a concurrent resolution introduced by Rep. Boustany (R-LA) and co-sponsored by 11 Republicans that would express Congress’ opposition to new fees on oil. While non-binding, the resolution would put Congress on the record as opposing one option for fixing the Highway Trust Fund (HTF). For years now the HTF has been spending more than it has been bringing in. It has been propped up with $140 billion in general fund transfers since 2008. Its primary funding source, the motor fuels tax, has not been increased since 1993 and inflation has decreased its value by 40%. Unstable and insufficient federal funding for surface transportation is one the main reasons our infrastructure is in such poor shape. ASCE’s 2013 Report Card for America’s Infrastructure gave our nation’s roads a D, our bridges a C+ and our transit a D. The U.S. is on track to invest less than half of what is needed in surface transportation over the next decade. This will have a cascading impact on our nation’s economy, impacting productivity, GDP, employment, personal income, international competitiveness, and, most importantly, public safety. Every year this funding gap is not addressed it will cost American families $3,400 – that’s $9 a day because of underperforming infrastructure. The HTF needs a long-term funding solution and in order to get there, all options need to be on the table. H. Con. Res. 112 would eliminate a viable funding alternative and does not offer any strategy to #FixTheTrustFund and repair America’s deteriorating transportation infrastructure. Along with 30 coalition partners, ASCE sent a letter to Congress standing up for infrastructure and opposing H. Con. Res. 112. Want to help #FixTheTrustFund? Tell your congressman to oppose H. Con Res. 112!130 Congressmen Ask Colleagues to Fix the Highway Trust Fund

June 3rd, 2016 | By: Laura Hale

Last week 130 Members of Congress (73 Democrats and 57 Republicans) sent a letter to Chairman Brady (R-TX) and Ranking Member Levin (D-MI) of the House Ways & Means Committee urging them to include addressing the long-term solvency of the Federal Highway Trust Fund (HTF) in their plans for overhauling the U.S. tax code. They wrote: “The need for improvements to our nation’s infrastructure and safety programs is long overdue. However, the current finances of the HTF make it unable to support those investments…We recognize that tax reform legislation will be a heavy lift. Finding a solution requires ingenuity and will involve building consensus among competing interests and ideas, but we stand ready to work in partnership to reach this critical goal.” The HTF is supposed to fully fund the federal government’s investments in roads, bridges and transit, but for several years now it has been spending more money than it is taking in. The root of the HTF’s solvency problem lies in its primary funding source: the federal motor fuels tax. The federal motor fuels tax of 18.4 cents per gallon for gas and 24.4 for diesel has not been raised since 1993 and inflation has decreased its real value by 40%. To fill the gap, Congress has been diverting general fund dollars into the HTF since 2008. The FAST Act, the five year surface transportation bill signed in December 2015, included a $70 billion transfer from the general fund to the HTF. Even with the passage of the FAST Act, our nation’s current level of investment in surface transportation is less than half of what’s actually needed. ASCE’s new report shows that the U.S. needs to invest an additional $1.1 trillion in surface transportation over the next ten years (from federal, state, local and private sources). Failing to sufficiently invest in America’s deteriorating infrastructure will have a cascading impact on our nation’s economy, impacting business productivity, GDP, employment, personal income, international competitiveness, and, most importantly, public safety. The report found that if the surface transportation funding gap is not addressed, the U.S. will lose over $1.2 trillion in GDP and 1.1 million jobs by 2025. Over the past 30 years, all increases in the federal motor fuels tax have occurred as a part of larger tax reform packages, Therefore, Reps. Brady and Levin’s work could offer an opportunity for Congress to finally provide an adequate, sustainable funding source for the HTF. ASCE strongly supports increasing the federal motor fuels tax a sufficient amount at the federal level to stop the need for general fund transfers and allow for increased investment to close the widening gap. Additionally, ASCE supports the creation of additional pilot programs to test charging motorists based on how much they use roads with the long-term goal of using mileage-based user fees to fund the federal HTF.Report Offers Ways to Make Federal Transportation Investment More Productive

February 24th, 2016 | By: Becky Moylan

Now that the FAST Act has provided five years of certain funding for surface transportation programs, it’s time for Congress to once again turn to the important work of finding a long-term, sustainable funding solution for the Highway Trust Fund. A guaranteed funding source is key to allowing states to effectively plan and execute transportation projects. To aid in this process, the Congressional Budget Office (CBO) released last week a report titled “Approaches to Making Federal Highway Spending More Productive.” The report points out that federal investment in highways does not correlate accordingly with how roads are used. It also finds that federal road funding has been based primarily on formula grants, not taking into account the amount of travel on roads. It goes on to say that while maintaining existing capacity is becoming increasingly more important, investment has not shifted accordingly. The CBO also offers how the federal funding could be more productive and suggests three approaches for Congress to consider, including:- Charging drivers directly for road use more often, including based on traffic congestion

- Allocating funding to states based on the costs and benefits of specific projects

- Linking investment to performance measures on congestion and road quality

2015 Media Relations Year in Review

January 8th, 2016 | By: Olivia Wolfertz

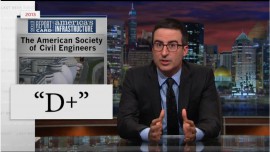

Last year, ASCE was mentioned in the media more than 12,900 times in all 50 states and in more than 30 countries around the world, including 27 major print and broadcast media outlets and wire services. ASCE members and staff interviewed on everything from the state of the nation’s infrastructure to fixing the Highway Trust Fund to Game Changers to the impact of natural disasters on infrastructure. Here are some of the major highlights from 2015: HBO’s Last W eek Tonight with John Oliver (3/2/15) highlighting the state of the nation’s infrastructure

eek Tonight with John Oliver (3/2/15) highlighting the state of the nation’s infrastructure

- Episode has been viewed more than 5.9 million times on YouTube

Op-ed in The Hill (7/27/15) authored by Bob Stevens touting ASCE’s Game Changers report.

CNBC Closing Bell interview (5/13/15) with Brian Pallasch following the Philadelphia Amtrak derailment

Fix the Trust Fund national radio tour led by Andy Herrmann

Op-ed in The Hill (7/27/15) authored by Bob Stevens touting ASCE’s Game Changers report.

CNBC Closing Bell interview (5/13/15) with Brian Pallasch following the Philadelphia Amtrak derailment

Fix the Trust Fund national radio tour led by Andy Herrmann

- Total listenership: 11.9 million

- Total number of airings: 2,064

- Number of stations airing: 1,814

FAST Act Summary Part Three: Transit

December 14th, 2015 | By: America's Infrastructure Report Card

This is the third in a series of summaries over the next few weeks on the contents of the newly-passed five-year federal surface transportation authorization law, Fixing America’s Surface Transportation (FAST) Act. The first part explored the law’s funding and the future fiscal health of the Highway Trust Fund. The second part described the highway program elements of the law. The final forthcoming section will focus on the policy changes to federal passenger rail programs. The FAST Act provides $305 billion for highway, transit and railway programs. Of that, $60 billion is for transit, which represents an 18% increase in public transportation funding over the law’s five-year duration. Most of the percentage bump in transit investment will occur in the first year with the program seeing an immediate nine percent increase. Here is what the transit investment levels look like over the life of the bill:- (Pre-FAST Act) Fiscal Year (FY) 2015: $10.7 billion

- (Post-FAST Act) FY16: $11.8 billion

- FY17: $12 billion

- FY18: $12.2 billion

- FY19: $12.4 billion

- FY20: $12.6 billion

- Creates a new Bus and Bus Facility Discretionary grant program to address capital investment. This program is funded at $268 million in the first year, rising to $344 million in the last year. The program also includes a 10 percent rural set-aside and a cap that no more than 10 percent of all grant funds can be given to a single grantee;

- Creates an expedited project delivery pilot program in the Capital Investment Grant program for projects with less than 25 percent federal funding and those which are supported through public-private partnerships;

- Focuses on the need to address resilience in state and local planning by urging a reduction on the natural disaster vulnerability of existing transportation infrastructure;

- Directs USDOT to review the safety standards and protocols used in public transportation. The Secretary will then evaluate the need to establish additional federal minimum public transit safety standards; and

- Makes $199 million available to assist in funding the installation of Positive Train Control (PTC) safety technology.

FAST Act Summary Part Two: Highways

December 9th, 2015 | By: America's Infrastructure Report Card

This is the second in a series of summaries over the next few weeks on the contents of the newly-passed five-year federal surface transportation authorization law, Fixing America’s Surface Transportation (FAST) Act. The first part explored the law’s funding and the future fiscal health of the Highway Trust Fund. The next sections will focus on the policy changes to transit and federal passenger rail programs. The FAST Act provides $305 billion for highway, transit and railway programs. Of that, $233 billion is for highways, which represents a 15% increase in road and bridge funding over the law’s five-year duration. Most of the percentage bump in highway investment will occur in the first year with the program seeing an immediate five-percent increase. Below are the highway investment funding levels over the life of the bill:- (Pre-FAST Act) Fiscal Year (FY) 2015: $40.3 billion

- (Post-FAST Act) FY16: $42.4 billion

- FY17: $43.3 billion

- FY18: $44.2 billion

- FY19: $45.3 billion

- FY20: $46.4 billion

FAST Act Summary Part One: The Funding

December 6th, 2015 | By: America's Infrastructure Report Card

This is the first in a series of summaries over the next few weeks on the contents of the newly-passed five-year federal surface transportation authorization law, Fixing America’s Surface Transportation (FAST) Act. The next sections will focus on the policy changes to highways, transit and federal passenger rail programs. The backbone of federal transportation funding is the motor fuels tax, and those revenues are deposited in the protected Highway Trust Fund (HTF). Taxes on gasoline and diesel fuels for cars, trucks and motorcycles, have been levied for many decades, however the last time that the tax rate was raised was in 1993 — over 20 years ago. Since that time, federal spending on highways and transit programs has risen and the purchasing power of those dollars, as a result of rising construction and materials costs, has gone down. While the newly-passed five-year federal surface transportation authorization law, Fixing America’s Surface Transportation (FAST) Act, increased investment, it did not pay for these funding increases through a gas tax hike. Instead, the law relied on a variety of items unrelated to transportation, specifically two large offsets dealing with the Federal Reserve (Fed). OFFSETS The first Fed offset is one that was heavily opposed by banks. The provision would reduce what was a six percent annual dividend paid to banks on Fed stock that they bought when becoming members of the Federal Reserve system. The reduction would impact banks with over $10 billion in assets and cut the stock dividend pay-out to match the interest rate of the highest-yield 10-year Treasury note, which would likely be around two percent. This provision raises nearly $6 billion for the FAST Act. The second Fed-related offset is the largest one contained in the FAST Act and applies to the Feds capital surplus accounts. The Fed regional banks maintain various amounts of surplus cash, which added together amounts to $29 billion. The FAST Act takes $19 billion from this account and leaves a $10 billion surplus cushion at the Fed. However, due to Congressional budget scoring procedures the amount of money actually raised for FAST Act by doing this $19 billion draw-down is about $53 billion because Congress adds up all of the money that would have been in the account over a ten-year budget horizon. Added together, these and other offsets amount to around $70 billion in new money for the HTF over the five-year life of the FAST Act. This means that at the end of the FAST Act the HTF will have received over $140 billion in general fund transfer since it began experiencing fiscal trouble in 2008. This also means that by the end of the FAST Act gas taxes and other transportation-related revenues will only be providing half of the dollars necessary to support investment levels, which could complicate the policy process in numerous untold ways. For example, members of Congress may then ask: “Why should this program only fund roads and transit systems (which has historically been the case) if roads users and transit riders are no longer the funding basis of a large amount of the program’s revenues?” FUNDING LEVELS The FAST Act provides $305 billion for highway, transit and railway programs. Of that, $233 billion is for highways, $49 billion is for transit and $10 billion is dedicated to federal passenger rail. By the end of the bill’s five-year duration, highway investment would rise by 15%, transit funding would grow by nearly 18%, and federal passenger rail investment would remain flat. Most of the percentage bump in investment will increase immediately with highways seeing a five percent jump and transit receiving a nine percent jump in the first year. The funding then sees relatively flat, two percent annual growth. The bill actually provides higher levels of funding than the Senate-passed DRIVE Act would have, by over $680 million cumulative over the life of the bill. The bill also contains a HTF contract authority rescission of $7.5 billion at the end of the bill (September 30, 2020). This rescission would mean that states will have to return a certain amount of unobligated highway contract authority to FHWA. It is likely that states will soon plan their programs accordingly to be able to minimize the impact of this final-year budget cut. Rescissions have become common in surface transportation authorization bills as a way to bring down spending levels at the end of the law, which helps reduce the overall cost of the program for Congressional budget scoring purposes. There will likely be an effort in 2020 to eliminate or delay the implementation of the rescission. The last rescission to take effect was for $8.7 billion in 2009. Here are some funding highlights for highway and transit programs: HIGHWAYS- National Highway Performance Program: annual increases of nearly $500 million;

- Surface Transportation Program: first-year increase of $1 billion and nearly $200 million on top of that annually thereafter;

- Highway Safety Improvement Program: slight increase of $50 million annually;

- Congestion Mitigation & Air Quality Program: $50 million increase in the first-year and slight increase thereafter;

- TIFIA Program: heavy annual reduction from $1 billion per year to $275 million – $300 million annually throughout the bill;

- Highway Research & Development Program: slight increase, however new eligibilities added:

- $15 million annual Surface Transportation Funding Alternatives Studies program; and

- $10 million annual Performance Management Data Support program.

- (NEW) National Highway Freight Program: approximately $1.2 billion annually; and

- (NEW) Nationally-Significant Freight & Highways Projects Program: approximately $900 million annually.

- Formula and Bus Grants: $800 million increase in the first year and $200 million on top of that annually thereafter. Within that:

- $90 million annual increase for Urbanized Area Formula Grants;

- (NEW) $28 million for Research & Development Demonstration and Deployment grant (existing FTA R&D program reduced by $50 million annually);

- State of Good Repair: first-year $350 million increase and $40 million on top of that annual increase thereafter;

- (NEW) Bus and Bus Facility Discretionary program: approximately $300 million annually; and

- (NEW) Fast Growth and High Density program: approximately $550 million annually.

- Capital Investment Grants: Initial $400 million funding increase which sustains for life of the bill; and

- Positive Train Control Grants: $200 million provided in fiscal year 2017.

Obama Set to Sign 5 Year, $305 Billion Transportation Bill

December 4th, 2015 | By: America's Infrastructure Report Card

Yesterday, the U.S. House of Representatives and U.S. Senate both approved a five-year, $305 billion highway, transit and railway authorization bill. The overwhelming, bipartisan vote was 359-65 in the House and 83-16 in the Senate. President Obama is expected to sign the bill into law later on today. Thank you, infrastructure supporters, for contacting your members of Congress, which certainly helped secure this victory!

In the run-up to the vote, ASCE leadership urged adoption of the legislation known as the Fixing America’s Surface Transportation (FAST) Act. The FAST Act provides nearly $233 billion for highways, $49 billion for transit and $10 billion federal passenger rail. By the end of the bill’s five-year duration, highway investment would rise by 15% and transit spending would grow by nearly 18%. The FAST Act is the longest surface transportation authorization bill since the enactment of a previous five-year bill in 2005.

The bill includes:

Yesterday, the U.S. House of Representatives and U.S. Senate both approved a five-year, $305 billion highway, transit and railway authorization bill. The overwhelming, bipartisan vote was 359-65 in the House and 83-16 in the Senate. President Obama is expected to sign the bill into law later on today. Thank you, infrastructure supporters, for contacting your members of Congress, which certainly helped secure this victory!

In the run-up to the vote, ASCE leadership urged adoption of the legislation known as the Fixing America’s Surface Transportation (FAST) Act. The FAST Act provides nearly $233 billion for highways, $49 billion for transit and $10 billion federal passenger rail. By the end of the bill’s five-year duration, highway investment would rise by 15% and transit spending would grow by nearly 18%. The FAST Act is the longest surface transportation authorization bill since the enactment of a previous five-year bill in 2005.

The bill includes:

- Creation of a dedicated $1.25 billion freight program to help ensure federal investments are targeted at improving U.S. economic competitiveness;

- Providing $900 million per year for large-scale projects under a new, nationally-significant freight and highways program;

- Cutting the TIFIA program from $1 billion annually to around $300 million per year. TIFIA helps leverage billions of dollars in private sector capital for investment in our nation’s infrastructure;

- Innovation initiatives, such as establishing a national program to explore surface transportation funding alternatives to the fuels tax; and

- Investment in transit by creating a new research and deployment program, increasing funds for fixed guideways, and establishing a new bus facility program.

Conference Committee Meets on Highway & Transit Bill

November 19th, 2015 | By: America's Infrastructure Report Card

Yesterday, the joint House & Senate conference committee on the surface transportation authorization legislation met in what will likely be its only public meeting before the looming December 4 deadline to finalize work on a bill. The conference committee chairman, Rep. Bill Shuster (R-PA) kicked-off the meeting by stating, “There is plenty of common ground between the [House & Senate] proposals to allow us to reach an agreement that both [chambers] can willingly support.” The lead House Democrat on the committee, Rep. Peter DeFazio (D-OR), underscored the importance of achieving an increase in overall funding in the final bill. “I’m hopeful to get higher levels of spending on an annual basis and if funds are so limited that we have to reduce the term of the bill, it’s an option I think should be looked at,” said DeFazio. The committee announced a timetable to final action on a bill, which includes finalizing the conference agreement by November 30 and having a House vote on the bill by the December 4 deadline. It remains to be seen whether the Senate will be able to act before the December 4 target or if they will need a week extension to approve the legislation and present it to President Obama for his signature. Either way, all members of the committee seem hopeful that a final agreement will be reached very soon and that they can craft a measure that will receive the necessary votes in both the House and Senate to be signed by the president. ASCE, along with other groups like the U.S. Chamber of Commerce, believes a five-year program that includes significant funding increases, rather than a six-year bill that only maintains the status quo, should be the final goal of the conference committee. That sort of legislative package will help create jobs and grow the economy in the years ahead.

*/ ?>

*/ ?>