The Clock Ticks Louder

May 8th, 2015 | By: Olivia Wolfertz

With the end of May approaching and no long-term transportation funding bill on the horizon, a short-term patch will likely be Congress’ next move. If you’re thinking this is de ja vu from last summer, you’re not alone.In Missouri, the state gas tax has not been raised in 20 years, despite construction costs rising by 200 percent. Because Missouri has 1,600 bridges that are more than 75 years old, lack of funding is a growing issue. After an emergency bridge closure disrupted traffic flow this week, Governor Jay Nixon encouraged lawmakers to pass a bill that would increase the tax on motor fuels by 1.5 cents and the diesel tax by 3.5 cents. Without action, the governor said Missouri won’t have enough revenue to match federal dollars, which means the state will not see needed repairs, resulting in more traffic, and fewer jobs. In Nebraska, the unicameral legislature passed a 6-cent gas tax increase over four years, Legislative Bill 610, Gov. Ricketts promptly vetoed the bill, which now returns to the legislature for a likely override. In Michigan, Proposition 1, which would have increased the state gas tax and raised $1.3 billion for road maintenance, was vehemently rejected, leaving Michiganders left with poor road conditions and back at the drawing board to increase investments. On a positive note, in Washington state, both the House and Senate have passed separate bills to increase state transportation funding. The House plan gives Sound Transit authorization to ask voters for up to $15 billion to extend its light-rail system, and House democrats want to continue using some sales-tax revenue collected from construction projects for the general fund. The Senate plan would authorize up to $11 billion, and would funnel that money back to transportation projects. Right now there is no certainty over which plan will prevail. Both plans include similar highway, bridge and pedestrian projects and raise about $15 billion over 16 years by gradually increasing the gas tax to 11.7 cents. Next week is Infrastructure Week, which could not come at a more opportune time as Congress has 22 days until the highway and transit policy expires. It is crucial these conversations lead to action that ensures a sustainable, long-term funding solution to #FixTheTrustFund.#TBT to a year ago when we heard a year would give “the space” to do a long-term bill. It’s time to #fixthetrustfund pic.twitter.com/x5dzY4IGFf

— Senator Tom Carper (@SenatorCarper) May 7, 2015

Flat Funding is Flat Outrageous

May 7th, 2015 | By: Becky Moylan

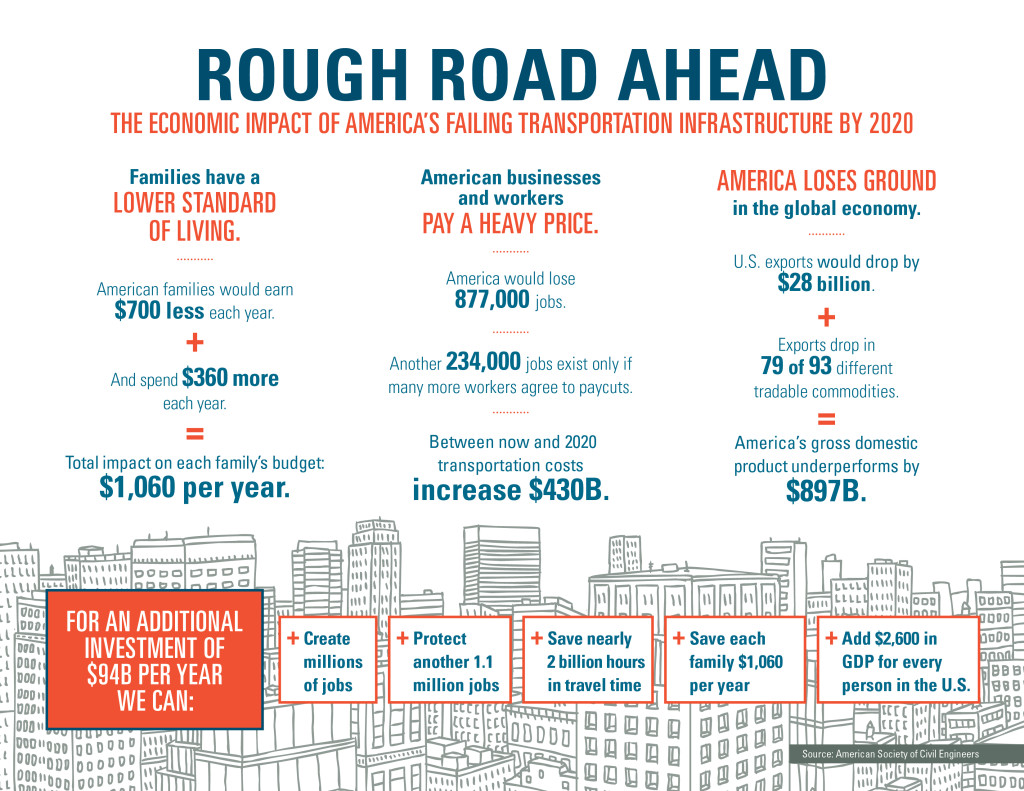

As the deadline to reauthorize the federal surface transportation bill nears, the measure of success for many involved seems to be maintaining the status quo. Last week, leaders in the U.S. House of Representatives began touting “flat funding” as an accomplishment that Congress must work to achieve. But it’s flat out not. Here are some of the things that will happen if Congress simply continues the status quo over the next few years, from ASCE’s economic study on transportation:- It will cost each American family’s budget $1,060 every year through at least 2020

- America will lose more than 876,000 jobs by 2020

- 234,000 jobs will force workers to take paycuts in 2020

- S. exports will drop by $28 billion in total by 2020

- America’s GDP will underperform by $897 billion in total by 2020

A multiyear bill that continues the same amount of funding we’ve had since 2005 through SAFETEA-Lu is the opposite of aspiration. It will not help improve our low Report Card grades for surface transportation, and will do little to strengthen the economy. However, there is a way to not only fill the funding hole of the Highway Trust Fund but also grow the system. By increasing the federal gas tax, we can start investing in the projects America needs to have in place in order to continue to compete globally in the21st century. Every state has dozens of new construction projects that they would like to make a reality if they only had increased investment from all levels of government. Here’s our chance.

To fill the current federal funding gap and grow the federal Highway Trust Fund to address current documented needs, Congress should raise the gas tax by at least 20 cents. This would be the first increase since 1993, and the bump would recoup what has been lost due to inflation and increase funding. For the average driver, it will cost about $187 more a year*. In contrast, right now each motorist is paying $324 a year in additional repairs and operating costs. In addition, Americans spend an average 34 hours a year stuck in traffic, costing the U.S. economy $101 billion in wasted fuel and lost time annually. It’s a savings for your wallet by staying out of the auto mechanic shop. It’s an even bigger savings as it protects that $1,060 mentioned above.

There is a lot at stake if we merely continue with the same level of funding of the past 10 years for the next five. It will hurt your personal finances, hurt our already aging transportation system and do little to benefit our economy. Let’s increase our investment so that Congress truly fixes the Trust Fund in a way that allows us to modernize our transportation system.

Join ASCE in telling your Senators and Representative that you expect their leadership in passing a long-term, sustainable fix to the Highway Trust Fund that includes an increased investment to modernize the transportation system.

*calculated based on 18 gallon tank x 20 cents x 52 fill-ups a year (once a week)

A multiyear bill that continues the same amount of funding we’ve had since 2005 through SAFETEA-Lu is the opposite of aspiration. It will not help improve our low Report Card grades for surface transportation, and will do little to strengthen the economy. However, there is a way to not only fill the funding hole of the Highway Trust Fund but also grow the system. By increasing the federal gas tax, we can start investing in the projects America needs to have in place in order to continue to compete globally in the21st century. Every state has dozens of new construction projects that they would like to make a reality if they only had increased investment from all levels of government. Here’s our chance.

To fill the current federal funding gap and grow the federal Highway Trust Fund to address current documented needs, Congress should raise the gas tax by at least 20 cents. This would be the first increase since 1993, and the bump would recoup what has been lost due to inflation and increase funding. For the average driver, it will cost about $187 more a year*. In contrast, right now each motorist is paying $324 a year in additional repairs and operating costs. In addition, Americans spend an average 34 hours a year stuck in traffic, costing the U.S. economy $101 billion in wasted fuel and lost time annually. It’s a savings for your wallet by staying out of the auto mechanic shop. It’s an even bigger savings as it protects that $1,060 mentioned above.

There is a lot at stake if we merely continue with the same level of funding of the past 10 years for the next five. It will hurt your personal finances, hurt our already aging transportation system and do little to benefit our economy. Let’s increase our investment so that Congress truly fixes the Trust Fund in a way that allows us to modernize our transportation system.

Join ASCE in telling your Senators and Representative that you expect their leadership in passing a long-term, sustainable fix to the Highway Trust Fund that includes an increased investment to modernize the transportation system.

*calculated based on 18 gallon tank x 20 cents x 52 fill-ups a year (once a week)

Tags: gas tax, highway trust fund, surface transportation

No Comments »

Michigan Back to Square One to Fix Roads

May 6th, 2015 | By: Maria Matthews

On May 5 voters from Detroit to Marquette resoundingly opposed the idea of a change to the state constitution invest in better and safer roads. In an 80% to 20% vote Michiganders opted to consider “Plan B” rather than enact a slight increase in sales and fuel taxes that would have raised $1.3 billion for road maintenance and improvements.

Ensuring adequate investment in Michigan’s roads has been a long time goal for Gov. Rick Snyder. He had this to offer after yesterday’s poll results came in:

“It’s essential that making Michigan’s infrastructure safer remains a top priority. While voters didn’t support this particular proposal, we know they want action taken to maintain and improve our roads and bridges. We appreciate that this bipartisan plan was supported by so many groups – business leaders and unions, public safety officials and local governments, teachers, and the list goes on. I plan to work with my partners in the Legislature on a solution that gives Michigan residents the safe roads they need and deserve and bolsters our growing economy.”

No matter what path is used to move Michigan forward, the sentiment from voters and policymakers alike is that something must be done to improve roads. There is general consensus that the state must act now. In this vein the Governor and legislators have begun to get to work on a viable alternative to Proposition 1. There are currently 10 plans in varying stages of development that could help Michigan meet it transportation infrastructure needs. Options range from vehicle-miles traveled to toll roads to a gas tax increase that would focus exclusively on fuel (rather than packaged together with other tax code changes as appeared on Tuesday’s ballot).

While defeat is never an easy pill to swallow, the time is now to regroup and continue to urge action. ASCE’s Michigan Section along with a number of municipal, agriculture and business groups came together to advance the idea of road funding and will extend their campaign until a solution is achieved. Carey Suhan, PE, President of the Michigan Section of the American Society of Civil Engineers also offered these thoughts on the rejected ballot measure:

“Michigan’s roads and bridges are among the worst in the nation because of underinvestment for the past five decades. As civil engineers, we witness the challenges of trying to run a 21st century transportation network using an outdated funding source. Unfortunately, Michigan voters chose to continue this trend in underinvestment, meaning our state will continue to have poor road conditions. It is now up to our elected leaders to offer another solution to improve Michigan’s roads, bridges and public transit.”

The current condition of Michigan’s roads and bridges was recently assessed by TRIP, a private nonprofit organization that researches, evaluates and distributes economic and technical data on surface transportation issue, found that Michigan’s underinvestment in recent years has resulted in further deterioration of its roads – there’s been a 23% increase in the percentage of major roads in poor condition. What’s scarier is this number is projected to increase to 53% by 2025 if the state and localities cannot keep up with regular maintenance and improvements.

If Michiganders want smoother and safer roads in the years to come, adequate revenue must be collected and allocated to maintain and improve the state’s transportation infrastructure now. With many other states taking action recently, Michigan will only fall further behind if lawmakers do not implement another plan quickly, Investing in better roads mean safer daily commutes and a brighter future for the state’s economy.

On May 5 voters from Detroit to Marquette resoundingly opposed the idea of a change to the state constitution invest in better and safer roads. In an 80% to 20% vote Michiganders opted to consider “Plan B” rather than enact a slight increase in sales and fuel taxes that would have raised $1.3 billion for road maintenance and improvements.

Ensuring adequate investment in Michigan’s roads has been a long time goal for Gov. Rick Snyder. He had this to offer after yesterday’s poll results came in:

“It’s essential that making Michigan’s infrastructure safer remains a top priority. While voters didn’t support this particular proposal, we know they want action taken to maintain and improve our roads and bridges. We appreciate that this bipartisan plan was supported by so many groups – business leaders and unions, public safety officials and local governments, teachers, and the list goes on. I plan to work with my partners in the Legislature on a solution that gives Michigan residents the safe roads they need and deserve and bolsters our growing economy.”

No matter what path is used to move Michigan forward, the sentiment from voters and policymakers alike is that something must be done to improve roads. There is general consensus that the state must act now. In this vein the Governor and legislators have begun to get to work on a viable alternative to Proposition 1. There are currently 10 plans in varying stages of development that could help Michigan meet it transportation infrastructure needs. Options range from vehicle-miles traveled to toll roads to a gas tax increase that would focus exclusively on fuel (rather than packaged together with other tax code changes as appeared on Tuesday’s ballot).

While defeat is never an easy pill to swallow, the time is now to regroup and continue to urge action. ASCE’s Michigan Section along with a number of municipal, agriculture and business groups came together to advance the idea of road funding and will extend their campaign until a solution is achieved. Carey Suhan, PE, President of the Michigan Section of the American Society of Civil Engineers also offered these thoughts on the rejected ballot measure:

“Michigan’s roads and bridges are among the worst in the nation because of underinvestment for the past five decades. As civil engineers, we witness the challenges of trying to run a 21st century transportation network using an outdated funding source. Unfortunately, Michigan voters chose to continue this trend in underinvestment, meaning our state will continue to have poor road conditions. It is now up to our elected leaders to offer another solution to improve Michigan’s roads, bridges and public transit.”

The current condition of Michigan’s roads and bridges was recently assessed by TRIP, a private nonprofit organization that researches, evaluates and distributes economic and technical data on surface transportation issue, found that Michigan’s underinvestment in recent years has resulted in further deterioration of its roads – there’s been a 23% increase in the percentage of major roads in poor condition. What’s scarier is this number is projected to increase to 53% by 2025 if the state and localities cannot keep up with regular maintenance and improvements.

If Michiganders want smoother and safer roads in the years to come, adequate revenue must be collected and allocated to maintain and improve the state’s transportation infrastructure now. With many other states taking action recently, Michigan will only fall further behind if lawmakers do not implement another plan quickly, Investing in better roads mean safer daily commutes and a brighter future for the state’s economy.

Tags: gas tax, infrastructure, Michigan

No Comments »

Majority of Americans Say Yes to Gas Tax Increase to Fund Transportation

April 30th, 2015 | By: Becky Moylan

In the debate on how to best fix the Highway Trust Fund, often times lawmakers shy away from the most direct funding source: a raise to the federal gas tax. Its last increase was in 1993, and since that time it has lost a third of its purchasing power. While many states have taken bipartisan action in the past few years to better fund their roads, bridges, and transit using this method, federal lawmakers have continued to be reluctant as previous research has indicated opposition to an increase. However, a new research poll shows that a majority of voters would support an increase to the gas tax, so long as it goes toward better transportation infrastructure. The study, released by the Mineta Transportation Institute, found 69 percent of respondents willing to pay a 10-cent per gallon increase for improved road maintenance. In addition to supporting an increased investment in roads and bridges, two-thirds of respondents also agreed that some gas tax revenues should go toward transit, as most people want good public transit service in their state. As Congress must act by May 31 to reauthorize the surface transportation law, this new study demonstrates that voters support finding the needed funding through an increase to the gas tax. While the 10-cent increase tested in this research would not grow our system in the future, it can act as a springboard to improve America’s roads, bridges, and transit. The bottom line: Americans want better transportation and they are willing to pay for it.Tags: bridges, gas tax, highway trust fund, public transit, roads

1 Comment »

Ideas to Fix the Trust Fund

April 17th, 2015 | By: Olivia Wolfertz

Congress returned to Washington this week after a two week recess, facing a new level of urgency to Fix the Highway Trust Fund before last summer’s extension ends on May 31. A few members of Congress wasted no time upon their return to the Hill to start raising this issue and offering their solutions. On Thursday a bipartisan group of House members filed legislation to increase the federal gas tax to match inflation in order to finance our much-needed transportation investment. The Bridge to Sustainable Infrastructure Act would increase the gas tax to recoup its purchasing power, thus generating $27.5 billion that can be used to pay for nearly two years’ worth of transportation. In the release announcement explaining what prompted the lawmakers to propose this solution, Reps. Jim Renacci (R-Ohio), Bill Pascrell (D-N.J.), Reid Ribble (R-Wis.), and Dan Lipinski (D-Ill.) explained “We refuse to pass on the liability of our deteriorating roads and bridges to our children and grandchildren. The longer we wait to fix our crumbling infrastructure, the more it will cost in the long-run,” in a joint statement about the bill. On April 15, Representative Delaney and Representative Hanna wrote a letter to their fellow members of Congress emphasizing the importance of committing to a long-term sustainable funding bill and supporting their bill, the Infrastructure 2.0 Act that has bipartisan support to repatriate overseas capital for domestic infrastructure repairs. On the Senate side, Sen. Rand Paul (R-Ky.) and Sen. Barbara Boxer (D-Calif.) have a bill to replenish the Highway Trust Fund, also through repatriation. All three of these efforts exemplify that infrastructure has historically been a bipartisan success, and that finding a solution to federal transportation investment is no different. Finding a long-term federal transportation funding solution affects each state and its ability to effectively plan projects. According to the U.S. Department of Transportation, Arkansas, Delaware, Georgia, Mississippi, Tennessee and Wyoming have already postponed transportation projects because of funding delays. With 44 days until the highway and transit policy expires, it is crucial these conversations lead to action that ensures a sustainable, long-term funding solution to #FixTheTrustFund.Tags: gas tax, highway trust fund, surface transportation

No Comments »

Seven States Say “Yes” to Gas Tax Modifications

April 13th, 2015 | By: Maria Matthews

Seven state legislatures used this year’s session to address infrastructure investment. These states used a variety of available revenue sources to raise money for their aging roads and bridges. No matter what sort of package these states put together, the common thread was that they all included an adjustment of the gas tax.

ASCE supports an all options on the table approach to ensuring transportation infrastructure receives adequate funding. States that followed suit and pushed through funding measure that included gas tax increases include:

Seven state legislatures used this year’s session to address infrastructure investment. These states used a variety of available revenue sources to raise money for their aging roads and bridges. No matter what sort of package these states put together, the common thread was that they all included an adjustment of the gas tax.

ASCE supports an all options on the table approach to ensuring transportation infrastructure receives adequate funding. States that followed suit and pushed through funding measure that included gas tax increases include:

- Georgia – Governor Nathan Deal signed a $1 billion transportation funding package approved by the General Assembly on March 31. The bill converts the current state sales tax on gas to an excise tax set at 26-cents per gallon for passenger vehicles and 29-cents per gallon for commercial vehicles among other fee increases. Despite the size of the package, it is estimated that much of the newly generated revenue will be directed toward the maintenance and improvement of existing roads.

- Idaho – Idaho extended its legislative session for the purposes of addressing its funding shortfall. After pushing through competing proposals, the two chambers came together in a last-minute conference committee to achieve a 7-cent increase effective July 1, 2015 and a combination of increase user fees and access to available funds from future budget surpluses. While a great stride for Idaho, unfortunately, this bill will only generate an estimated $94 million of the $262 million in additional funding the state needs. (This bill is currently awaiting Governor Butch Otter’s signature.)

- Iowa – The first and fastest to act on an increase to their gas tax. While the vote was many years in the making, both chambers consented to raising the gas tax by 10-cents per gallon within a matter of hours. Governor Terry Branstad signed it into law the next day and four days later more money was being raised for transportation projects. The revenue generated by this increase will be used to fund the maintenance of Iowa’s structurally deficient bridges and provide an additional revenue stream for transportation projects at the local level.

- South Dakota – Governor Dennis Daugaard signed into law a 6-cent per gallon gas tax increase effective on April 1. It is estimated the increase in the gas tax and other motor vehicle fees will generate $85 million a year for state and local transportation projects. The measure also creates a “local bridge improvement grant fund” through which some of the newly generated revenue will be distributed.

- Utah – Utah was the second state to approve a gas tax increase in 2015. The increase goes into effect January 1, 2016. It will also continue to increase in future years using a system similar to the state’s sales tax. The bill also imposes a 12% tax on the wholesale price of gas when the price of gas reaches $2.45 a gallon and the overall gas tax rate been capped at 40-cents. Utah has made a number of positive investments in its transportation systems in recent years and this increase will ensure the state can plan accordingly for wear-and-tear and meet the needs of the growing population.

- Kentucky –The legislature here voted to freeze its gas tax at 26-cents per gallon. While this is about a 1.5-cent per gallon decrease, it avoids a projected 5.1-cent per gallon decrease in upcoming months. The legislature also used this measure to modify its funding formula in the hopes of preventing future dips.

- North Carolina – In a single day, the legislature passed and the Governor signed a 1.5-cent decrease in its gas tax effective April 1 and a reduction to 34-cents per gallon by January 2016. While this will not raise funds immediately, like Kentucky’s freeze, this measure will prevent a dramatic drop in the rates later this year. A new formula for calculating the gas tax will take effect on January 1, 2017 and is expected to result in additional revenue, in the form of a projected 2% increase per year, for the state’s Highway Trust.

States Stepping Up

March 24th, 2015 | By: Becky Moylan

A growing number of states are taking action during their legislative sessions to increase investment in transportation. This trend is in vogue for several reasons. First, many states that have taken action have done so after years of kicking the can down the road. For example, Iowa’s 10-cent increase is the first boost since 1989. In that time, the cost of most other goods has nearly doubled. Yet, Iowa was trying to fund 2015 roads and bridges on 1989 dollars. That underinvestment was costing the state’s economy in other ways, as a recent assessment by TRIP demonstrated. Iowa’s roads and bridges are costing each Iowan $2 billion in additional vehicle operating costs, lost time and fuel due to traffic congestion, and financial costs from traffic accidents. Thanks to the increased revenues, the state will begin addressing many of its needs. Second, bipartisan action reflects the increasing understanding that deferring maintenance in the face of a funding deficit hurts economic competitiveness. Utah, another state that passed gas tax increase legislation this session, is expected to have huge population growth in the coming decades. To meet future needs, as well as address a projected funding shortfall, that state needed to increase its investment. Investing in roads and bridges has historically been a place of agreement from both sides of the aisle, and that trend continues this year. Another reason we have seen action is that people are sick of potholes and sitting in traffic and are becoming increasingly vocal about their desire to have safe, well-maintained roads and bridges. In the press release South Dakota Gov. Daugaard issued after signing his state’s gas tax increase into law, he emphasized that maintaining roads and bridges is one of the fundamental functions of government. The more lawmakers hear from constituents on the need for better roads and bridges and greater access to transit, the more likely they are to make it a legislative priority. Several other states are poised to take action this year that would better fund transportation. In legislative action, Idaho, Georgia and Washington are all considering and compromising on bills that would address each respective state’s needs. Also on the horizon are Minnesota, North Carolina and Nebraska. In Michigan, voters will head to the polls on May 5th to decide on a ballot measure that would increase funding for the Great Lakes state’s transportation network—a measure endorsed by many influential groups, the Governor, and the Detroit Free Press. All of this action at the state level, however, cannot take the place of the federal government’s essential role in transportation investment. To continue the momentum of this year’s state action—along with the trend of the past few years—the U.S. Congress needs to find a long-term, sustainable solution to fix the Highway Trust Fund. If they fail to act, our nation’s economic competitiveness is in jeopardy and states will be stuck with a much larger tab, or an even longer backlog of projects.Tags: congress, gas tax, highway trust fund, state government

No Comments »

The Excitement of Infrastructure

March 2nd, 2015 | By: Becky Moylan

HBO’s Last Week Tonight with John Oliver “proposed” a movie on the importance of infrastructure maintenance.

Tags: failure to act, gas tax, highway trust fund

No Comments »

This Week in Infrastructure: State Solutions, Innovations for Infrastructure Improvement

February 20th, 2015 | By: Olivia Wolfertz

A bus tour sharing the message we need to invest in infrastructure to “Grow America”, increased momentum towards state-level gas tax increases and new transportation innovations are all building momentum towards improving our nation’s infrastructure. On Wednesday morning in Los Angeles a water main broke that was installed in 1926, causing flooding and damage to nearby buildings and roads. According to The Times’ analysis of LA Department of Water and Power (DWP) data, Los Angeles’ system of water pipes has averaged nearly 1,200 leaks a year since 2010, and water main leaks and breaks occur on average about three times a day across the city. Vice President Joe Biden and Transportation Secretary Anthony Foxx recently returned from a tour through five states to promote the Grow America Act, which would invest $478 billion in infrastructure across the nation. It would be partly paid for through a one-time tax on currently untaxed corporate earnings, is considered by Biden and Foxx to be a bipartisan funding initiative and critical to economic growth and job creation. In absence of federal funding solutions, many states have come up with innovative ways to fund local transportation infrastructure. Aside from raising state gas taxes, which Iowa and Utah legislatures are in the process of doing, there have been innovative technologies to help improve safety and make trips easier. For example, the Minnesota Department of Transportation (MnDOT) has created an app that would assist the visually impaired to get around the city by navigating them and helping them avoid construction sites, as many are left to navigate the cities by foot due to lack of sufficient transit[MB1] In Los Angeles, a new app was launched to allow riders to pay for the commuter buses via their mobile phones with the aim of promoting more ridership on public transit. Regardless of innovative transportation improvements and state gas taxes, The Highway Trust Fund is headed towards insolvency in a matter of months. It’s imperative that members of Congress work together to pass legislation that will provide a sustainable, long-term funding solution to #FixTheTrustFund.Tags: gas tax, highway trust fund, water infrastructure

No Comments »

This Week in Infrastructure: Infrastructure Won't Fix Itself

February 13th, 2015 | By: Olivia Wolfertz

It is not a news flash that America’s infrastructure needs serious attention and investment. In light of increased attention to our nation’s surface transportation needs, many states are proposing increasing the gas tax to fund transportation. In addition, there has been an uptick in the number of news stories highlighting the need to be more strategic in the way we fund infrastructure. After chunks of concrete fell this week from a bridge on the DC Beltway in Maryland onto a moving vehicle, Manager of Public and Government Affairs at AAA Mid-Atlantic said “this is yet another reminder of why transportation funding in Maryland is so critically needed.” This incident prompted Transportation Secretary Anthony Foxx to underscore the necessity of providing funding to maintain and repair the nation’s bridges. Pennsylvania’s bridges have also received media attention lately, with 22 percent of the state’s bridges classified as structurally deficient, making it the highest percentage in the country. In an effort to fund their aging transportation infrastructure, more and more states are considering gas tax increases. Iowa is proposing a 10-cent gas tax hike that would generate close to $215 million a year for Iowa’s road system. Utah is recommending a bill to raise diesel fuel by 10 cents per gallon for road and bridge maintenance. Georgia is considering a $1 billion transportation funding plan that would steer gasoline tax revenue toward asphalt and concrete repairs. Though increasing state-level gas taxes is a step in the right direction, long-term, sustainable federal funding is critical to restore the nation’s infrastructure, as the states need the federal government to continue being a trusted partner in transportation projects. Transportation Secretary Anthony Foxx told Congress this week that temporary funding patches do not provide enough money for states and local governments to finance “badly needed long-range construction projects,” noting that the Obama administration has proposed a measure to spend $478 billion over the next six years. As states continue to make decisions with limited budgets, one tool that can help them make the most of the investment is life cycle cost analysis. Vox recapped a study by Smart Growth America, reaching similar conclusions to ASCE’s Maximizing the Value of Investment Using Life Cycle Cost Analysis report. Increased investment is essential in maintaining our transportation system in a state of good repair. By using effective planning tools such as life cycle cost analysis coupled with an increased investment, America will be better equipped to modernize its transportation system. Regardless of states’ efforts to fund transportation infrastructure, the Highway Trust Fund is headed towards insolvency in a matter of months. If there is no fix it will be detrimental to every state and our economy It’s imperative that members of Congress work together to pass legislation that will provide a sustainable, long-term funding solution to #Fix-the-Trust Fund.Tags: bridges, gas tax, highway trust fund, infrastructure

1 Comment »

*/ ?>

*/ ?>